OTC derivatives clearing has been en vogue for the past 15 years, but the foreign exchange (FX) market still hasn’t gotten the memo.

While Dodd-Frank, EMIR, and capital- and margin-based frameworks, such as Uncleared Margin Rules (UMR) and the Standardized Approach for Counterparty Credit RISK (SA-CCR), have led to a noticeable increase in the clearing of many OTC derivatives, the take-up in FX has been slower. The reasons are understandable: FX instruments are not mandated to be cleared; FX transactions generally have a shorter tenor, limiting counterparty risk; and certain FX transactions are excluded from the initial margin (IM) calculation. These, in addition to the perceived additional costs, have dampened the incentive to clear. Conversely, the clearing of interest-rate swaps has grown dramatically over the past decade and now accounts for approximately 75% of the overall market. FX participants will always be more selective about what they clear and perhaps never attain 75%. Nevertheless, volumes are finally increasing as the driver shifts from a lack of proscriptive clearing mandates to the need for prudent financial resource management.

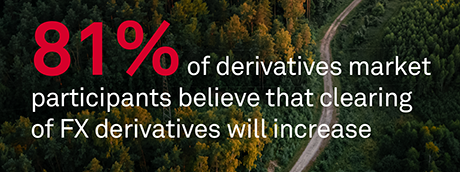

This renewed focus on the efficient use of capital, balance sheet, credit, margin, and collateral are motivating the FX markets to catch up. For some, these factors affect the pricing of a trade, counterparty relationships and portfolio decision-making (for a more detailed look, please see Derivatives Market Structure 2023: Optimization is not at the Margins). For others, the result is clearing. FX clearing opportunities are expanding, the market structure is evolving, and the cost of capital is rising—all tailwinds for FX clearing growth. But notable hurdles, including a lack of clearing mandates, remain.

MethodologyCoalition Greenwich conducted interviews with 120 FX professionals between January and March 2023 to ascertain their views on the direction of the FX market. In addition, Coalition Greenwich interviewed 60 senior derivatives market participants across North America, Europe and Asia from January to February 2023 to identify key trends in the derivatives market. Questions in both sets of interviews explored investment priorities, challenges in today’s market, and how firms will respond to regulatory and other market drivers.