In today’s world, data is what keeps markets moving. Market data, reference data, alternative data, and anything else that can be stored on a computer are now the biggest inputs into the investing and trading process.

In this Greenwich Report, the second of a three-part series made possible by Refinitiv, we’ll examine the impact of data on financial markets, which data is likely to become the most valuable over the next five years, who will provide that data, and how traders hope to put it to use.

The amount of data available today is staggering, but acquiring it, analyzing it and putting it to use has become more complicated than ever. The possibilities are fascinating—the ability to analyze consumer behavior via mobile phone geolocation data and apply that information to investing is amazing and would have been impossible a decade ago. But finding usable signals in what can be trillions of unstructured data points requires much more than a spreadsheet.

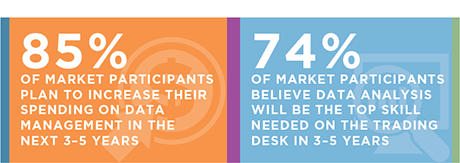

Our data shows that the value of financial data is only increasing, with interest in alternative data—data not traditionally used for trading and investing—topping the list. The evolution of analytics, both for investing and measuring execution quality, is as critical as acquiring the data itself. Data, therefore, is not simply the buzz topic of the moment, it is the path forward for trading.

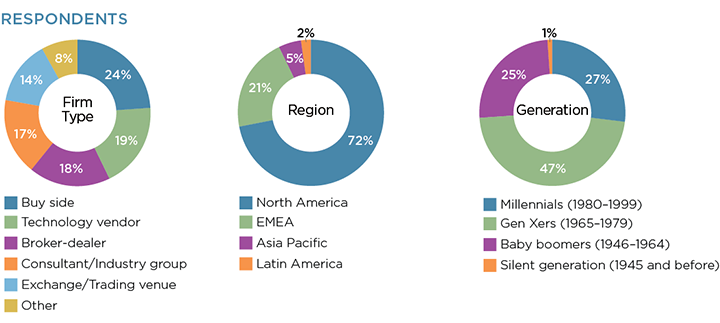

MethodologyIn April 2019, Greenwich Associates conducted an online study with 107 capital markets professionals globally. The study examined the technology trends, the data explosion and the skills required to be successful in capital markets in the future.