When selecting an asset manager to partner with, institutional investors rank trust in the brand higher than even the ability to achieve high returns. This demonstrates that while technology is dramatically changing investing, people still gravitate toward working with partners they can trust over time. For asset managers, achieving the position of “trusted advisor” is no easy task. It requires a multifaceted approach and engagement with a potential partner throughout their buyer’s journey. Providing insightful and relevant content in an easily accessible format is one way a manager can stand out. Data from this study highlights how institutional investors are increasingly consuming and using content via digital and social media:

- 86% of investors say they take action on content they receive, with 41% doing so at least weekly.

- 63% of institutional investors now consume social media while less than half regularly consume finance-specific trade publications.

- 68% of investors used social media to research asset management firms in 2018, up from 36% in our 2015 study.

- 59% of respondents spent on average 15–30 minutes reading a single piece of content, showing that long-form content still works.

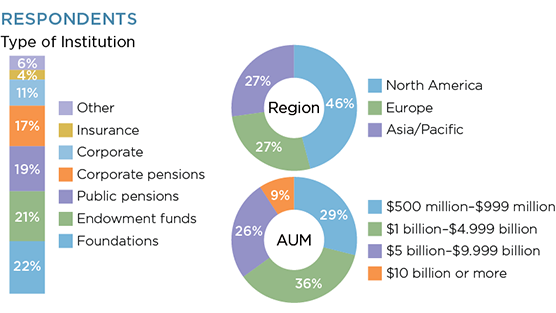

Greenwich Associates interviewed 277 institutional investors between August and November 2018. Located in North America, Europe and Asia, these senior investment professionals at pensions, endowments, foundations, and unions discussed their habits and views regarding the use of media in the investment process and its impact on investment decisions. This report was commissioned by LinkedIn.