Crisil Coalition Greenwich, in partnership with SIX for the third consecutive year, conducted an in-depth study of 50 global buy-side firms to uncover the latest trends and innovations in market data consumption, distribution and technology adoption. The research provides a comprehensive snapshot of the evolving market data landscape, examining the types and frequency of data usage, including the growing demand for real-time and historical tick data. With a particular focus on the transformative impact of emerging technologies, this report delves into the adoption and applications of artificial intelligence and machine learning (AI/ML), as well as the strategic role of cloud infrastructure and application programming interfaces (APIs) in shaping the future of market data delivery and consumption.

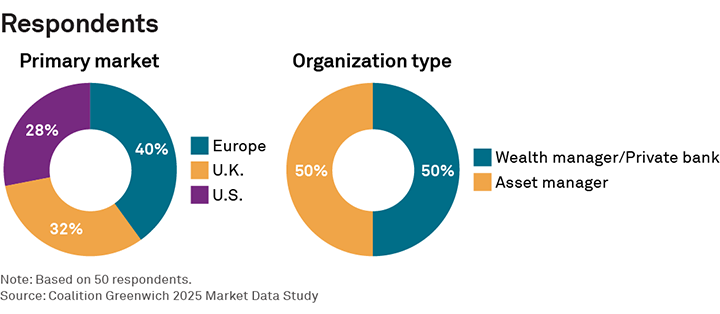

MethodologyThis study is an update to our series of annual studies designed to better understand the trends and challenges of market data consumption by asset managers and wealth managers/private banks in the United States, the United Kingdom and Europe. Between June and July 2025, Crisil Coalition Greenwich employed a detailed questionnaire to gather responses from 50 buy-side firms. The majority of insights stem from professionals in both front-office and middle-office roles, including portfolio management, trading and research, and market data specialists.