The vast majority of the market is investing more into data. However, far more thought and research is being put into which firm these market participants will work with as a vendor. As sources of data and data types grow, there is the possibility and inclination to engage a wider vendor base without forgoing quality.

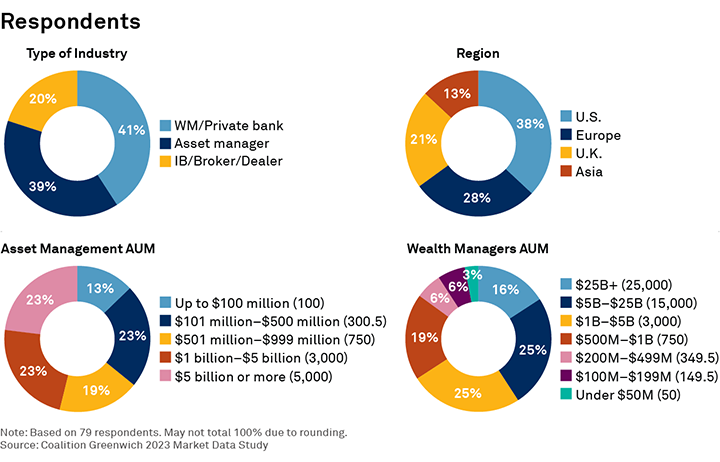

MethodologyDuring April and May 2023, Coalition Greenwich interviewed a total of 79 global buy-side and sell-side market participants to confirm what drives their choice of market data vendor, what types and frequency of data these firms are buying and consuming, and their views on anticipated future use cases, sources and delivery. The majority of opinions came from professionals working at either asset management firms or wealth management firms/private banks, with experts at dealers and banks making up the balance. Nearly half of asset management firms in our study reported AUM of at least $1 billion, with about one-quarter of that group reporting AUM of at least $5 billion. Likewise, respondents tended to work for larger wealth management firms/private banks, over half of which had AUM of $1 billion or more.

Looking across regions, the majority of participant business is conducted in the U.S., followed closely by Europe. U.K. and the APAC make up a smaller piece of the pie. While buy-side firms are distributed across all regions, nearly all sell-side respondents—which primarily consist of large global banks and dealers—conduct the majority of business in the U.S.

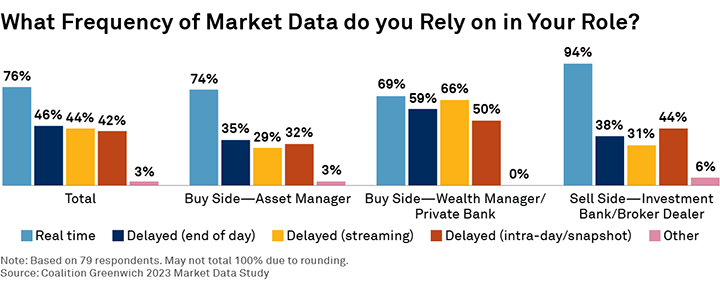

In most cases, participants hailing from buy-side firms have between one and 25 people within their area of responsibility or business function using market data. On the sell side, this figure was often much higher, with nearly one-third of participants pointing to over 100 people using market data. When it comes to the frequency of data being used, real-time data stood out from other frequencies as the preferred data type for both buy-side and sell-side study participants. As the market environment becomes more volatile and unpredictable, the value of real-time information grows and is leading capital markets professionals to increasingly rely on higher frequencies of information.

Appendix