Holistic surveillance practices have evolved significantly in recent years, and never more so than during the industry’s historic transition to remote working environments in 2020. Effective surveillance programs depend on key data analysis, aggregation and alert management workflow, but these key infrastructure functions are all dependent on data capture.

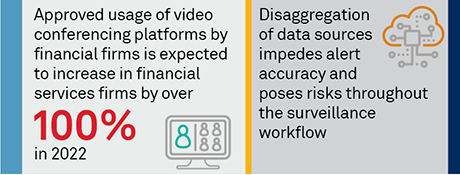

Despite significant technological advancements throughout the compliance monitoring chain, data capture remains a persistent stumbling block in the communications surveillance world. Alert accuracy is highly sensitive to input quality, process stability and comprehensiveness of data collection. The old adage, “garbage in, garbage out” holds true: Success is nearly impossible to achieve with analysis based on bad data. Incomplete data can be just as challenging.

As such, vulnerability in any of these areas carries a high risk of increased false positive/false negative alert rates. Understandably, errors in the crucial early data collection stages of this process can quickly compound to work directly against surveillance efforts. Compliance managers interviewed by Coalition Greenwich in 2021 report significant challenges in achieving the right balance of data capture, aggregation, analysis, and review. The structure of each firm’s ecosystem is unique; thus, there is no realistic one-size-fits-all approach despite the increasingly accessible platform solution options.

This report examines how financial services firms are approaching the task of thorough data capture, challenges in data processing infrastructure, and technology options to help firms patch infrastructure holes and overcome challenges in improving legacy approaches.

MethodologyIn the third quarter of 2021, Coalition Greenwich conducted in-depth interviews with more than a dozen financial markets professionals in the United States and Europe to discuss their current attitudes and approaches toward communications surveillance. Topics included current and future compliance technology spending, data management infrastructure, communications channel usage, technology adoption strategies, and demand for innovation and infrastructure upgrades going forward. Coalition Greenwich data, based on broad market outreach with the buy and sell side, examining marketwide spending and system usage trends was also used in this analysis.