The clear focus on compliance and operational efficiency is putting pressure on banks to be more agile and to rely more on third-party software and services providers. At the same time, trading and risk platforms supporting banks are in a race to expand functionality and improve workflow or they risk being a victim of consolidation by banks.

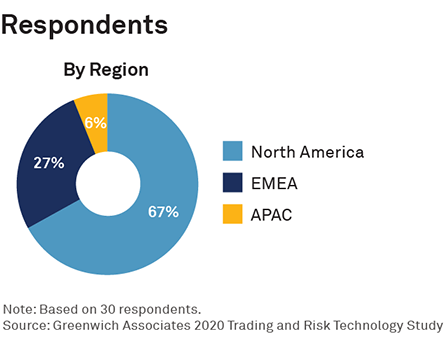

MethodologyBetween October and December of 2020, Greenwich Associates (now Coalition Greenwich) conducted interviews with 30 senior bank executives across the trading and risk function at Tier I/II/III banks in North America, Europe and Asia. Specific roles included Bank CTOs/COOs/CDOs, Heads of Risk Technology, and Heads of Trading (across multiple asset classes and products). Our conversations focused on business priorities, technology strategies, IT spending trends, the choice of technology platforms for trading and risk management, and the adoption of cloud and emerging technologies.