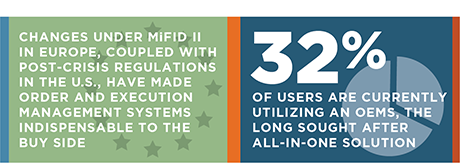

Technology spending by asset managers, hedge funds and other buy-side firms is quickly catching up to compensation expenses. It now accounts for 40% of the total budget, up from just below one-third only two years ago. Nearly one-quarter of those technology dollars are spent on access to order and execution management systems (aka, OMS and EMS).

While these systems have been critically important to trading desks for almost two decades, changes under MiFID II in Europe, coupled with post-crisis regulations in the U.S., have made them indispensable to the buy side. The bar has been raised for ensuring “best execution,” operational burdens are greater due to increased transaction reporting, and markets have only become more complex, with trading generally faster, more nuanced and more global. As such, a firm’s OMS/EMS is now just as entrenched on the desk as a large cup of coffee.

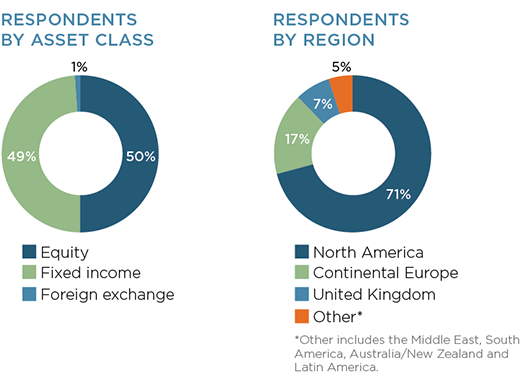

MethodologyFrom June through November 2017, Greenwich Associates interviewed 205 buy-side traders across the globe, working on equity, fixed-income or foreign exchange (FX) trading desks. Topics included trading desk budget allocations, trader staffing levels, OMS/EMS/TCA platform usage, and the impact of market structure changes on the sector.