Institutional adoption of digital assets is on the rise, leading to demand for the necessary technological and operational infrastructure to support trading and investing. Buy-side and sell-side institutions deciding to enter the market are confronted with a bewildering array of technology infrastructure choices across digital wallets, crypto custodians, settlement networks, staking providers, fiat currency support, and the universe of digital asset securities.

As a result, Coalition Greenwich set out to demystify the technology infrastructure options available to support digital asset investing across the full life cycle for institutions. The results of this independent study reveal the true state of the market in crypto custody and related services, with some surprises.

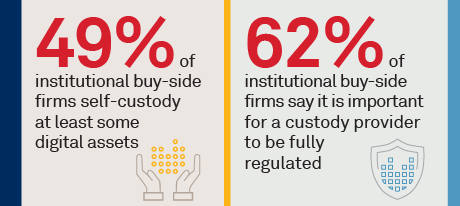

Today, Coalition Greenwich estimates that 49% of the institutional buy side involved in digital asset investing (including family offices, traditional and crypto hedge funds (HFs), venture capital (VCs), and traditional asset managers) self-custody at least a portion of their digital assets under management, while others choose a hybrid approach with a mix of self-custody and third-party custodians. We see the crypto asset mix as the primary driver of the custody decision, since even the longest-serving crypto custodians don’t support every asset or token.

Nothing in crypto is more important than security. Institutions have adopted a variety of digital wallet approaches to secure their digital assets under management, following both hardware-based and software-based approaches. For 78% of institutions, the most popular choice is a cold wallet/hardware-style solution. For those institutional buy-side firms that choose third-party custody for at least a portion of their digital assets under management, 41% choose institutional-grade, cold-storage solutions. As the market matures, institutions are likely to make more conservative and institutionally friendly choices.

Today, larger buy-side firms are basing infrastructure decisions on more than just the asset mix, focusing more on risk and regulatory. And while the assets driving buy-side custody decisions are primarily cryptocurrencies (true for 78% of buy-side firms), digital assets also carry considerable weight for the sell side.

Finally, regulatory clarity is still a major issue in digital asset custody. Both the sell and buy side believe fully regulated custody is important, with 71% of the sell side and 62% of the buy side saying this status is important/extremely important. The regulated status of custodians is an important topic for the industry, as only 35% of institutional buy-side firms claim to understand fully what it means for a custodian to be a qualifed custodian or QC, suggesting that greater outreach, education and clarity are needed for the industry to move digital asset custody forward.

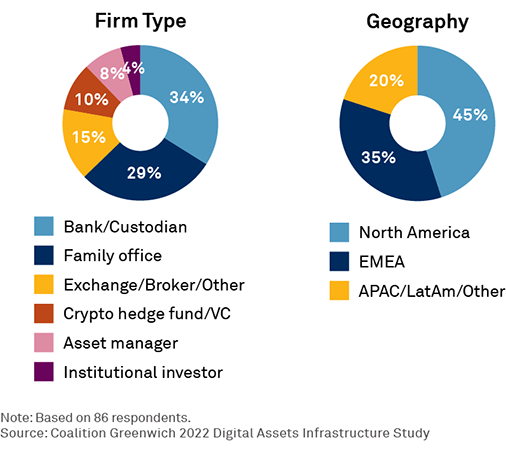

MethodologyIn Q3 2022, Coalition Greenwich conducted a study gathering 200 responses from institutional capital markets professionals of which 86 were qualified participants. By qualified, we mean individuals at firms who are up to speed on digital assets and able to offer insights based on their own experiences, including actual management of digital-asset investing strategies. The study comprised several types of institutions, including asset managers, crypto hedge funds/VCs, family offices, and pension funds/endowments, as well as banks, brokers, exchanges, and market infrastructure firms. Respondents were primarily from North America and EMEA, although some APAC/LatAm/other responses were also captured.