The shareholder litigation landscape is rapidly changing across the globe. The U.S. remains the most active region, with over 400 federal class action lawsuits filed in 2019. Over $3.2 billion in settlements were reached in U.S. cases (covering filings made from 2006 to 2019), and over $6.7 billion was distributed to damaged investors from settlements reached in prior years.

On the global scene, 2019 brought over 40 new opt-in/passive actions across nine separate jurisdictions. With all of this activity, Greenwich Associates sought to explore how investment managers in North America, EMEA and APAC were managing this increased volume and what they were anticipating their activity might be in the years ahead.

In this Greenwich Report, we take a deeper look into shareholder litigation trends over the past year. We examine the important factors driving participation in litigation and provide an overview of U.S. opt-out, non-U.S. opt-in and passive litigation.

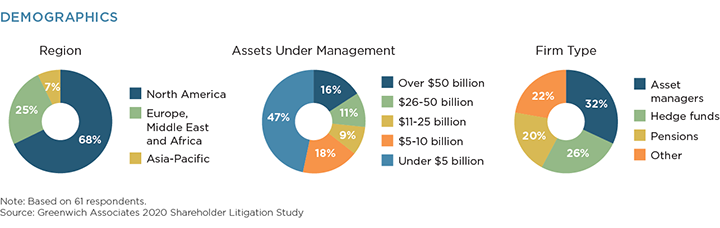

MethodologyIn Q4 2019, Greenwich Associates interviewed 61 firms across pensions, asset managers, hedge funds, and banks/custodians, among others. The research focused on understanding investor views of the shareholder litigation process, with particular attention on corporate governance, factors driving involvement, sources of information, and the firm’s internal policies.

The majority of firms responding were based in North America, with a quarter from EMEA and the rest from Asia-Pacific. Assets under management (AUM) ranged from nearly half (47%) at under $5 billion, up to 16% over $50 billion. Respondents were primarily asset managers (32%), hedge funds (26%) and pensions (20%), with the remainder spread across banks, custodians and proprietary trading firms.