Stablecoins are digital tokens pegged to major currencies or commodities and are often backed by transparent reserves, though not all follow this logic. Major stablecoins today include USDC, Dai and USDT. The majority of stablecoins are backed 1:1 by dollars and dollar equivalents, though issuers continue to provide further transparency into reserves. Regulators are demanding increasing visibility and accountability.

Stablecoins have the potential to enable greater access to the financial system for millions of Americans. They can give the unbanked access to the financial system and provide instant settlement and lower fees to the unbanked as well as a variety of other market participants. Moreover, stablecoins also have the potential to bring programmable money to the mass market, based on digital transfers of value using smart contracts.

To get a better sense of the current adoption of stablecoins, we conducted interviews with an informed audience of market participants focused on implementing blockchain solutions for capital markets, 70% of whom are at least somewhat focused on implementing blockchain solutions, with 45% very or extremely focused. Stablecoins are a real financial innovation and very promising. But the question remains whether they represent innovation for an interim period before central bank digital currencies (CBDCs) become available, or if they are truly “stable” and will serve as the financial rails for millions of Americans and global users, with a special focus on the highway on-ramps to the decentralized financial system (DeFi).

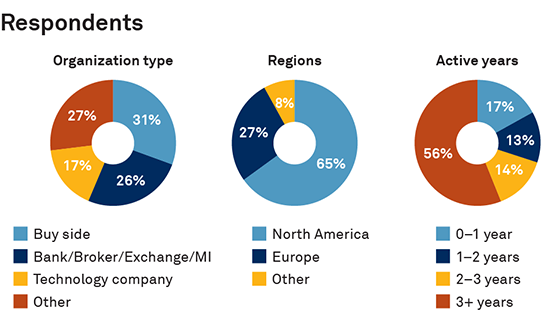

MethodologyIn July of 2021, we interviewed 108 executives at financial institutions and technology firms to better understand use cases, deployments, preferences, benefits, disadvantages, and the overall appeal of stablecoins. Respondents comprised asset managers, banks, brokers, exchanges, market infrastructures, technology companies, and other market participants.

We spoke with professionals in various roles across the front office, technology/operations/risk, senior management, and strategy teams. Over half of the respondents have been active in digital assets or blockchain technology for three years or more.