In every industry, data analysis is becoming a key competitive differentiator. Online retailers track users and clicks, shipping companies optimize logistics and in finance, just about every piece of information has a data value assigned to it. For decades, brokers, asset managers and pension plans have been tracking the performance of their trades in the market. The field of transaction cost analysis (TCA) has progressed from the first proprietary spreadsheets to a few niche providers to the array of independent providers there are today. Just about every large broker has in-house TCA specialists, and buy-side trading desks are using these tools for broker review and best execution compliance.

By now, one might think we have reached a saturation point and that products are trending toward commodity offerings. That is not the case, however. In fact, Greenwich Associates projects that TCA will become even more important and ingrained in the trading process going forward.

There are several factors supporting this. In equities, the narrative has been focused for many years on routing strategy and venue performance. In the United States, the market structure debate has become highly data-driven, with pilot programs implemented to measure performance in-sample and out-of-sample and across different categories before deciding on new regulations. Fixed income is becoming increasingly electronic, driving demand for decision-support analytics. And in Europe, MiFID II now mandates best execution policies across most asset classes.

For the buy side, TCA was once seen as a “tick-the-box” exercise but has become a differentiator, with many large buy-side trading desks now employing dedicated TCA professionals to help them eke out cost savings and improve performance for their institutional clients.

Our latest research looks at TCA adoption across asset classes, identifies the leading players in the space and highlights important trends in the industry.

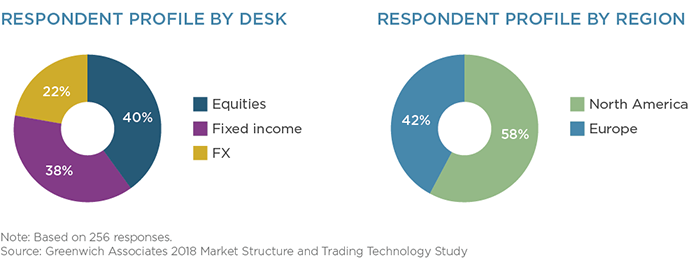

MethodologyBetween May and October 2018, Greenwich Associates interviewed 256 buy-side traders in Europe and North America, working on equity, fixed-income and foreign-exchange trading desks. Topics included trading desk budget allocations, trader staffing levels, OMS/EMS/TCA platform usage, and the impact of market structure changes on the sector.