While retail investors have taken to do-it-yourself tools in unprecedented numbers over the past two years, their use of financial advisors remains strong. Markets have generally gone up since the pandemic-induced crash of 2020, but they also remain complicated and uncertain, leaving retail investors in need of professional advice that even the best computer algorithms can’t provide.

Despite the natural demand, however, standing out in the crowd is increasingly complicated for even the best advisors. Financial advisors can no longer build their assets under advisory by suggesting an asset allocation and then moving on to the next customer. An ability to talk to clients about the benefits (or not) of environmental, social and governance (ESG) investing, the realness of cryptocurrencies and whether or not inflation is going to impact retirement savings is absolutely critical.

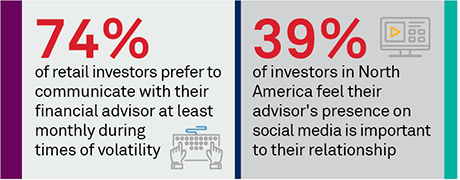

Furthermore, nearly 40% of retail investors noted that the presence of their advisor on social media—whether talking about the markets or interacting with them directly—is increasingly important to the relationship. Obviously, financial advisors today are not the same as the financial advisors used by our parents.

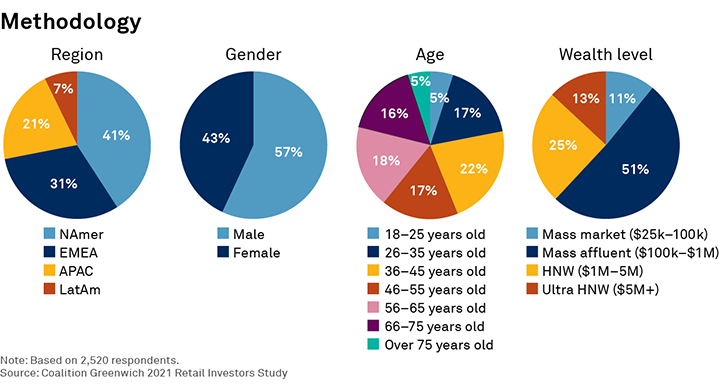

In an effort to better understand these quickly moving trends and the topics that matter most to retail investors, Coalition Greenwich electronically interviewed over 2,500 retail investors globally for a study commissioned by LinkedIn. The results paint a picture of what financial advisors need to do to stay relevant, what retail investors are thinking about as we enter a post-pandemic world and how the two groups can work together to achieve everyone’s stated goals.

MethodologyDuring August and September 2021, Coalition Greenwich interviewed 2,520 retail investors globally about their use of and experiences with financial advisors. The research targeted a mix of generational and wealth level representation to gather a deep understanding of investor behavior, sentiment and expectations now and in the coming years. This research study was commissioned by LinkedIn.