After several decades of relegation to the back office, 21st century compliance departments have emerged as front-and-center players in modern capital markets infrastructure.

Banks, asset managers and end investors now recognize the importance of the compliance function to both operations and revenue.

- Market participants, particularly sell-side firms, are indicating a strategic shift towards reliance on external personnel resources rather than maintenance of a standing expert knowledge base.

Regtech implementation has followed a reactive approach to new regulation since the financial crisis, resulting in piecemeal or even haphazardly planned compliance technology stacks, but firms are increasingly realizing the value of adopting a proactive approach—even if it results in an initially higher investment. Banks and broker-dealers currently drive over 70% of surveillance technology external spending, but demand among lower tiers and the buy side is growing approximately 20% per annum.

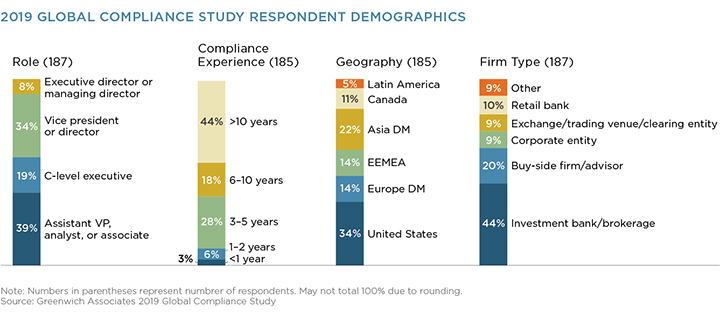

Throughout Q2 and Q3 2019, Greenwich Associates interviewed 187 professionals and executives working directly in compliance roles for the 2019 Global Compliance Study, executed in partnership with Nasdaq. Interviewees were highly experienced, with 61% working at a director or executive level, representing broker-dealers, buy-side firms, corporate entities, retail banks, and market infrastructure entities. Global distribution of respondents was wide, with the largest share of responses (34%) coming from the United States, followed by EMEA (28%), Asia (22%), and other geographies.

Proprietary analysis of the 2019 Global Compliance Study results was completed by Greenwich Associates. Historical study results dating back to 2015 were provided by Nasdaq and were used by Greenwich Associates to interpret trends over time, as the distribution of participant demographics have remained consistent. Where applicable, statistical significance testing was conducted by Greenwich Associates; statistically significant conclusions indicate that the selected responses lay outside of two standard deviations from the mean when tested at the 95% confidence level.

Spending estimates were formed using proprietary methodology and were based on feedback provided by asset managers, broker-dealers, market infrastructure operators, regulators, and members of the vendor community, as well as participants in the 2019 Global Compliance Study. Vendor community input included ACA Compliance, Bay Street Systems, Bloomberg, Eventus Systems, and Nasdaq.