Table of Contents

U.K. investment managers are working to maintain and enhance profit margins in the face of downward pressure on management fees. One area that managers are focusing on is client service, with some firms excelling relative to competitors. A good example is Bridgewater Associates—the 2018 Greenwich Quality Leader in U.K. Institutional Investment Management Service Quality.

“Several powerful trends are combining to drive management fees lower in the U.K.,” says Greenwich Associates consultant Mark Buckley. “Bridgewater Associates and other leading managers like Insight Investment and Baillie Gifford— the two runners-up for the title of 2018 Greenwich Quality Leader—are pushing back against this trend with an effective focus on client service. Our 2018 research indicates there is significant dispersion of investors’ perceptions of managers’ service capabilities, with a number of managers now perceived to be well behind the market leaders.”

The ongoing pooling of local authority pension schemes was undertaken largely for the explicit purpose of lowering overall costs—including the fees paid to external asset managers. That process is playing out against the backdrop of the much broader shifting of assets from active management to lower-cost passive strategies by institutional investors around the world.

As a result of these trends, 31% of the U.K. plan sponsors participating in the Greenwich Associates 2018 U.K. Institutional Investors Study expect the fees they pay to external asset managers to decrease over the next 12 months. That overall share includes 68% of local authorities, which see pooling as the main driver of fee reductions. Of the corporate plan sponsors expecting a decrease in total management fees, 60% expect to lower their own costs by renegotiating fees with asset managers.

Demand for Specialty Investment

A significant countervailing force against this downward fee pressure is institutions’ increasing demand for specialty investment products. Although average funding levels for defined benefit U.K. pensions have improved to a relatively healthy 94%, 55% of corporate pension schemes still report negative cashflows. Across the corporate and local authority sectors alike, pensions are relying on investment returns as the primary means of meeting funding requirements. To that end, corporate pension schemes are expecting their portfolios to outperform markets by 98 basis points (on the basis of five-year expectations), and local authorities are banking on 123 basis points of alpha.

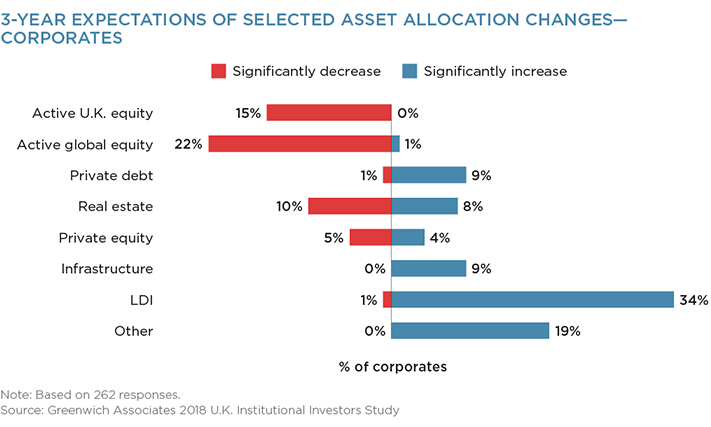

To achieve those levels of outperformance, U.K. plan sponsors are shifting assets from active U.K. and global equities into infrastructure, real estate, private debt, and other real assets and alternatives with higher alpha potential.

Focus on Client Service

Asset managers trying to maintain profitability in the face of these trends have two main weapons. First, managers can cater to investors’ growing demand for higher-fee specialty products. Next, they can work to preserve fee levels and margins on existing mandates by providing best-in-class client service that differentiates the firm from rivals and increases the value of the relationship in the eyes of the institutional client.

At a minimum, asset managers cannot afford any shortcomings in client service basics, such as reporting, prompt responsiveness to client inquiries and requests, and formal review meetings. But in this environment, that won’t be enough. Leaders in the industry, like 2018 Greenwich Quality Leader Bridgewater Associates and runners-up Insight Investment and Baillie Gifford, are providing clients with valuable intellectual capital and strategic advice and increasing the value they provide to clients in informal interactions.

Consultants Mark Buckley and Markus Ohlig advise on the investment management market in the United Kingdom and continental Europe.

MethodologyDuring the first quarter of 2018, Greenwich Associates conducted in-depth interviews with 381 key decision-makers at the largest institutional funds in the United Kingdom. Institutions included U.K. corporate funds, local authorities and other institutional funds, each with over £100 million in total defined-benefit plan assets, defined-contribution plan assets or other institutional assets.