This year’s massive cryptocurrency sell-off, with the overall market down over 70% from its peak, has done little to dampen the enthusiasm of players seeking to create a more institution-friendly environment for crypto investing.

The latest big move in the space: Intercontinental Exchange (ICE) announced their plans to spin off a new company, Bakkt1, focusing on institutionalizing crypto and developing the payment use case. At the same time, issuers continue to try and get approval to launch a bitcoin ETF, although the SEC recently rejected2 nine filings. And Coinbase, the largest U.S. crypto exchange, is developing a suite of institutional products3 and hiring seasoned Wall Street professionals to help them tackle this market.

In reality, however, institutional participation in the space remains low. Financial institutions investing in crypto are comprised of family offices, dedicated crypto funds, and a handful of hedge funds and proprietary trading firms.

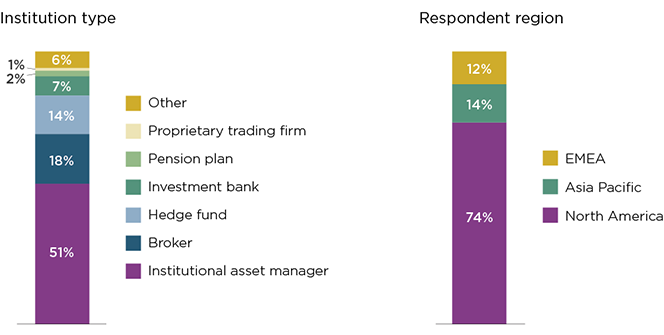

MethodologyBetween April and August 2018 Greenwich Associates interviewed 141 institutional market participants across North America, Europe and Asia. Respondents worked at a variety of organizations including asset managers, investment banks, brokers, and hedge funds.