Diminished liquidity in global bond markets is fueling demand for fixed-income ETFs among institutional investors in Europe and the United States. A large majority of the institutions in the Greenwich Associates 2017 Fixed-Income ETF Study say they increasingly face challenges in trading, liquidity and security sourcing, prompting about 60% to consider bond ETFs as an alternative vehicle for fixed-income exposure.

Due in large part to market liquidity and trading cost issues, 60% of institutions have increased their use of bond ETFs in the past three years, with allocations now averaging roughly 18% of total fixed-income assets. Institutions that have stepped up their use of the funds value the versatility of bond ETFs as a portfolio tool, employing them to obtain narrow and broad fixed-income exposures in both high-level strategic functions and targeted, tactical applications.

One-third of current ETF investors plan to increase bond ETF allocations over the next 12 months, with European institutions planning to boost ETF allocations an average of 19%, and U.S. institutions targeting increases of almost 30%. Based on those results and investors’ continued concerns about bond market liquidity, Greenwich Associates projects steady and, perhaps, even accelerating growth in bond ETF usage and investment among U.S. and European institutions for the next three to five years.

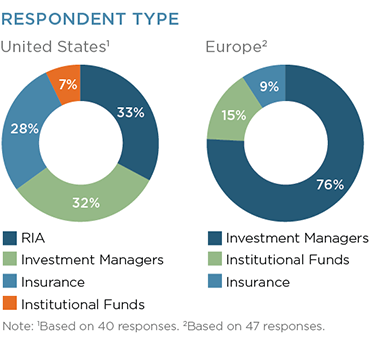

MethodologyGreenwich Associates conducted interviews with 87 institutions in the United States and Europe that currently utilize bond ETFs in their portfolios. The goal of this research is to understand trends impacting the fixed-income investment landscape and the evolution of fixed-income ETFs. Respondents include investment managers, insurers, institutional funds, and (in the United States) registered investment advisors (RIAs).