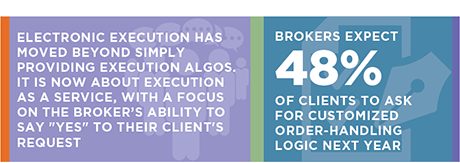

Electronic trading is an essential part of institutional investors’ workflow, and buy-side traders are increasingly asking brokers to customize trading algorithms to meet their specific requirements. Brokers recognize that being able to customize their offering is now a key part of the service they provide to their clients, even as it increases complexity within their own technology architecture.

To effectively service clients’ electronic trading requirements in today’s equities markets, it is important that brokers utilize a robust and performant technology platform with the capabilities to deliver a high level of flexibility.

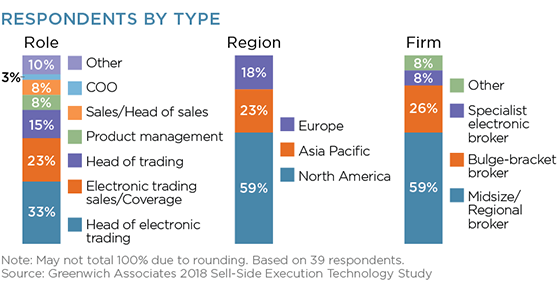

Between June and August 2018, Greenwich Associates interviewed 39 sellside trading executives in North America, Europe and Asia. Respondents were asked a number of quantitative and qualitative questions about requests for control and customization from their clients, the different coverage models employed and the increased technology capabilities required to manage the changing buy-side/sell-side relationship.