A wave of mergers and acquisitions among investment consultants is pointing the industry in the direction of a bifurcated business in which many relationships and client assets flow to the biggest firms with resources and scale, while smaller consultants carve out what they hope will be sustainable positions through specialization and/or higher-touch service offerings.

The asset management industry as a whole is consolidating. With management fees and industry profit margins under pressure, investment assets are concentrating in the hands of the world’s largest managers, who have been able to derive significant benefits from scale and investments in technology.

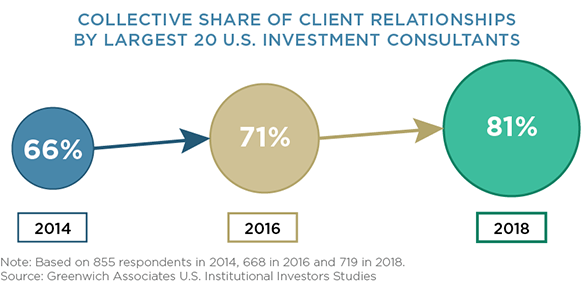

The investment consulting industry is in the midst of its own consolidation bout, driven by some of the same forces. One of the key drivers of change is the need for scale in order to meet the evolving expectations of consultants’ institutional clients. To keep pace with industry innovation trends, such as new technology platforms and an ability to offer more sophisticated analyses or even OCIO services to clients, firms are facing demands for notable investments (in the form of both money and time) in IT, HR and operations.

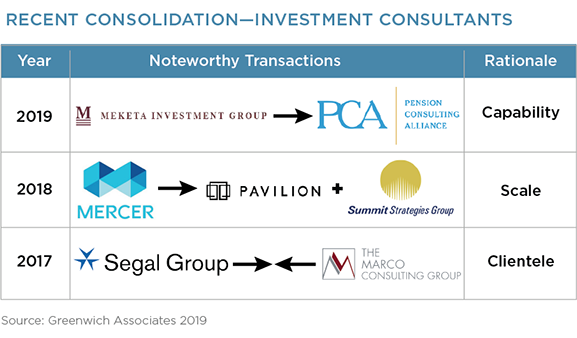

Today’s M&A wave is not just a game of scale, it’s also a quest for capabilities. The list of M&A transactions that have been announced and explored runs the gamut—from smaller or midsize consulting firms joining forces to compete, to some of the biggest names in the business considering combining into massive players resembling their biggest counterparts in asset management. However, that list also includes deals in which major consultants identify acquisition targets not for size and scale, but for specific specialist capabilities and/or access to new clientele.

“Underlying all of this activity is the demand on consultants to simply do more to service their clients,” says Greenwich Associates Principal Sara Sikes. “Institutional investors are looking to their consultants for data, insights, advice, and, in some cases, even full-scale solutions to investment or organizational issues. Delivering in these areas requires new skill sets and capabilities—similar to shifts and pressures we are seeing among the ranks of asset management organizations too.”

It is important to note that not all of the consultants on the list of Greenwich Quality Leaders℠ have participated in the M&A boom. Some firms that have stayed on the sidelines are banking on the fact that their expertise in certain product areas or their unique culture and more customized approach will allow them to defend and even expand niche market positions. Others are setting their sights on institutional clients looking for an experience different from that provided by large consultants, or those seeking a partner without the complications and potential conflicts inherent in OCIO and other newer areas of activity.

“There is definitely still a place for consultants who can deliver customized, high-touch service and objective advice to pension funds and other institutions who feel that they are being—or have the potential to be—lost in the shuffle with bigger consultants,” says Sara Sikes.

Regardless of size, consultants are feeling pressure to up their game. “Whether you enhance or expand your capabilities by buying another firm or choose to develop the right resources in-house, investment consultants are being pushed to bring new skills and offerings to the table,” says Sara Sikes. “The days when consultants could maintain the status quo and rely on long-standing relationships to keep their businesses afloat are long past. Remaining relevant and having a forward-looking approach is critical to continued success.”

All of the 2018 Greenwich Quality Leaders in Overall U.S. Investment Consulting have found ways to keep themselves relevant by expanding the value they offer to clients. Some accomplished that goal by acquiring other firms. Others did so by focusing on their traditional strengths, sticking to their knitting and remaining hyper-focused on enhancing the research, counsel and solutions they offer in order to set themselves apart from rivals.

Consultants Andrew McCollum, Davis Walmsley, Rodger Smith, Sara Sikes, and Susan Gould advise on the investment management market in the United States.

Between July and October 2018, Greenwich Associates conducted interviews with 1,128 senior professionals at 924 of the largest tax-exempt funds in the United States, including corporate and union funds, public funds, endowments and foundations, insurance general accounts, and healthcare organizations, with either pension or investment pool assets greater than $150 million. Study participants were asked to provide quantitative and qualitative evaluations of their asset managers and investment consultants, including qualitative assessments of those firms soliciting their business and detailed information on important market trends.