Table of Contents

Indian regulators are now putting in place reforms that may serve as the foundation for the country’s financial sector for decades to come. However, establishing a stronger risk management structure and building a solid, modern banking industry is no easy task. Banks, investors and commercial clients should all be prepared to deal with short-term turmoil as the old order gives way to a new 21st-century banking system.

In this report, we explore key themes surrounding:

- Current progress and impact of ongoing banking reforms

- Competitive landscape and outlook: Relative performance of public and private sector banks

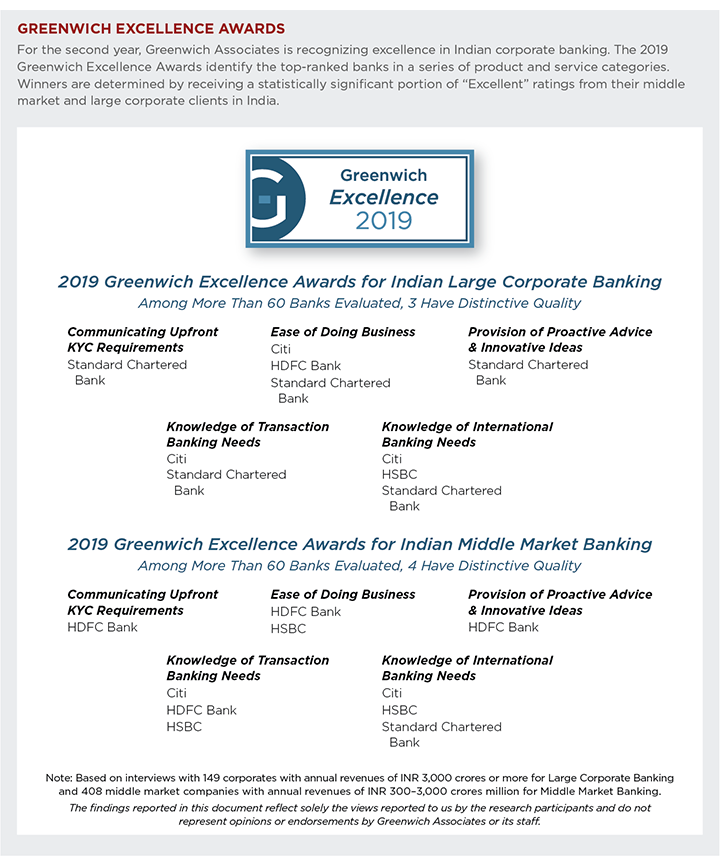

- Greenwich Share and Quality Leaders and Greenwich Excellence Awards

Current Progress and Impact of Ongoing Banking Reforms

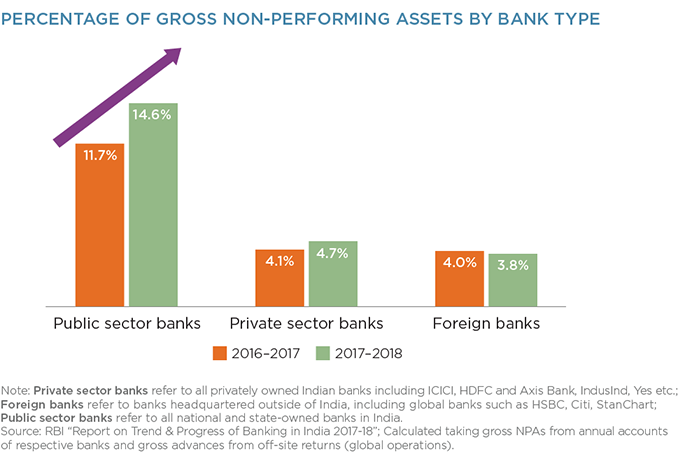

Stressed Assets: Slow Progress to Resolution – The single biggest issue facing the Indian banking sector—and indeed, one of the biggest issues facing India as a whole—is the health and solvency of the country’s public sector (PSU) banks. As the accompanying chart from the Reserve Bank of India (RBI) shows, gross non-performing assets (NPAs) among PSU banks grew to 14.6% of total assets in 2017–18 from 11.7% in 2016-17. This ratio represents a serious threat, considering that PSU banks represent some 70% of the Indian banking industry.

Regulatory actions such as the Central Repository of Information on Large Credits (CRILC) in 2014 and the Asset Quality Review (AQR) in 2015 actually contributed to an initial increase in reported NPAs among PSU banks by forcing banks to recognize underperforming loans. These efforts to shore up the sector have been buttressed by even more direct action from the regulator, including sizable cash infusions and the orchestration of mergers among PSU banks.

It now seems that some of these efforts are bearing fruit. NPA ratios are showing signs of moderating among some PSU banks in fiscal 2018–2019. In particular, State Bank of India’s gross NPAs fell 23% year-on-year. However, the NPA issue is far from resolved and, as the ongoing crisis among the country’s non-banking financial companies (NBFCs) crisis illustrates, there could be many still-hidden minefields for public sector and other Indian banks to navigate before declaring their balance sheets restored.

The default by IL&FS in August 2018 sparked fears of a wholesale credit crisis triggered by India’s fast-growing ranks of NBFCs. The magnitude of the event caused a fundamental change in approach by regulators, who have abandoned their traditional “light-touch” regulation of NBFCs in favor of a more proactive and aggressive approach. Going forward, the RBI will focus on the linkages between NBFCs and banks, and look to “harmonize” liquidity norms between the two, while still allowing for differences in business models.

Structural Reforms and Impact – One of the first and perhaps most important reforms enacted by Indian regulators in their attempt to modernize and stabilize the country’s banking system was the 2016 Insolvency and Bankruptcy Code (IBC). Although many details of the process are still being worked out, the IBC represents the country’s first real mechanism for orderly default resolution and asset recovery. The implementation of the new bankruptcy process was a key first step in addressing the issue of bank NPAs.

While IBC is clearly a step toward the right direction, progress has been slow. The number of actual resolutions is in single digits, which means a lot of tweaking is required before the process can be called a success.

Competitive Landscape and Outlook: Relative Strengths of Public and Private Sector Banks

Greenwich Associates interviewed a total of 557 India-based companies and foreign subsidiaries between Q4 2018 and Q1 2019. Of these, 149 are large corporates with annual turnover of at least INR 3,000 crores, and 408 are middle market businesses with turnover between INR 300 crores to 3,000 crores.

We track corporate usage of banking services (among other dimensions) based on their depth of relationship. “Lead relationships” refers to the top two (including domestic and international) overall banking relationships cited by a company.

Companies Turn to Private Sector Banks as Public Sector Banks Struggle

Due to their struggles with NPAs and other issues, India’s PSU banks are losing valuable lead banking relationships with the country’s largest companies. As of 2016, 20% of large Indian corporates said they used at least one PSU bank as a lead corporate bank, meaning they considered the bank one of their top two corporate banking providers. By 2018, that share had fallen to just 15%. The bulk of those relationships went to private sector banks. Even when they do retain their status as a company’s No. 1 or No. 2 credit provider, PSU banks are being cited less often as leading providers for non-credit products such as foreign exchange and cash management—roles that are being filled most often by private sector banks.

This shift is the direct and predictable outcome of the steady improvement in product and service quality on the part of India’s private sector banks and the continued struggles of the PSU banks—including restrictions placed on certain public sector banks by regulators.

The one outlier to this trend is State Bank of India. SBI, which has moved faster and made more progress than other PSU banks to address the NPA issue, actually increased its share of lead corporate banking relationships to 6% of large companies in 2018 from 4% in 2016. SBI has also posted dramatic gains in “cross-selling” FX and other non-lending products to companies for which it is a top credit provider.

Leading Indicator: Quality of Relationships

The Greenwich Quality Index (GQI) is a normalized composite of qualitative ratings of banks by their corporate banking clients. Metrics that are part of the GQI composite are listed at the end of the report. Scores mentioned below are the difference to industry average.

In 2017, the average GQI score for public sector banks was 50 points below the industry average. In 2018, it dropped to -70 points. Over that same period, the average GQI for Indian private sector banks increased from even with the mean to five points above the industry average. By way of comparison, the average GQI score for foreign banks competing in India is 40 points above the mean. The GQI for SBI climbed 10 points from 2017 to 2018.

These are ominous findings for any PSU banks not named State Bank of India. Quality perceptions as quantified in the GQI are forward-looking indicators. In other words, declining ratings today often signal changes of providers in the future. Already, Indian companies are turning over corporate banking providers at a rate rarely seen in other markets. Based on projections at the start of this year, Greenwich Associates estimates that 92% of Indian companies will make a change to their corporate banking rosters in 2019.

As corporate banking evolves, the oncoming wave of technology could potentially lead to a bleaker picture for PSU banks. The reason: The corporate banking landscape is being transformed by technology. Banks in every country are investing millions of dollars in IT—including both customer-facing digital applications designed to make banking easier for clients, and internal systems made to lower costs and create efficiencies. “Consumed with the NPA crisis, India’s public sector banks are in no position to make these critical technology investments, and as a result, they are likely to fall even further behind their domestic private sector rivals and foreign competitors, unless the situation is addressed urgently,” says Greenwich Associates consultant Gaurav Arora.

See the upcoming Greenwich Report “Future Outlook: Digital Capabilities Will Determine Winners and Losers in Indian Corporate Banking” for a complete analysis about how technology is transforming the Indian banking sector for both companies and providers.

Conclusion

Given the current dynamics of the industry and the priorities of the new government, it’s becoming increasingly clear that restoring India’s banking system to health is a priority. The potential implications could range from privatization/consolidation, to setting stronger corporate governance structures, to guidance on IT infrastructure upgrades. The geographic advantage that once secured the franchises of PSU banks in specific regions is being undermined by technology that allows companies to more easily employ the services of domestic private sector and foreign banks with a smaller physical footprint. Meanwhile, weak balance sheets and other immediate challenges are preventing PSU banks from making the long-term IT investments needed to compete for wholesale banking business in the future.

As Gaurav Arora concludes, “Even after recent mergers, it’s apparent that the PSU banks need to consolidate in order to achieve the scale needed to compete as well as ensure that banks are investing in people/platforms/technology to effectively compete in the future.”

Greenwich Share and Quality Leaders

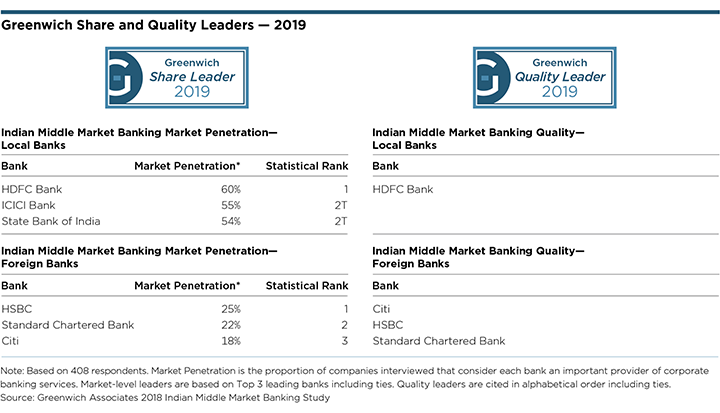

The 2019 Greenwich Share and Quality Leaders in Indian Corporate Banking are navigating a stressful and volatile period of transition, as the consequences of long-needed reform ripple through the marketplace. HDFC Bank and State Bank of India are at the top of the list of local banks. Each is used for corporate banking services by roughly three-quarters of large Indian companies. Close behind is ICICI Bank, with a market penetration score of 71%. These three banks also secure the top spots among middle market banking companies, with HDFC in first place and ICICI and SBI statistically tied in the No. 2 spot. In terms of Quality, HDFC has differentiated itself from all local bank competitors to claim the title of 2019 Greenwich Quality Leader℠ in both Large Corporate and Middle Market Banking.

Among foreign banks, Standard Chartered and Citi are tied statistically with a market penetration of 51%–54% among large Indian corporates, followed by HSBC at 50%. These banks are the 2019 Greenwich Share Leaders℠ in Indian Large Corporate Banking Market Penetration—Foreign Banks. In the middle market space, HSBC ranks first, with Standard Chartered in second and Citi a close third.

Greenwich Associates Head of Asia, Gaurav Arora, and consultant Winston Jin, specialize in Asian corporate/transaction banking and treasury services.

For more information: ContactUsAsia@greenwich.com, Gaurav.Arora@greenwich.com or call +65.6236.0142

MethodologyFrom September 2018 to March 2019, Greenwich Associates conducted interviews with 149 Large Corporates and 408 middle market businesses in India and asked them to name the banks they use for a variety of services, including corporate lending, cash management, trade services and finance, foreign exchange, structured finance, interest-rate derivatives, and investment banking.

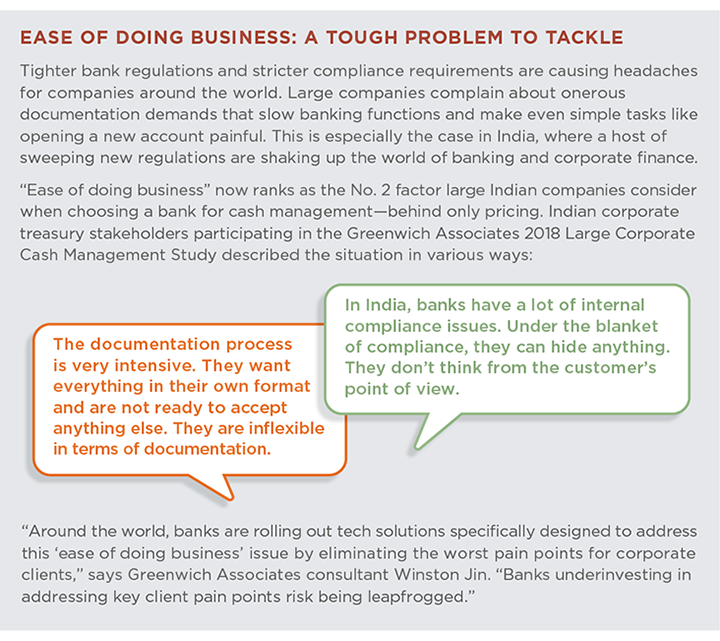

The Greenwich Quality Index (“GQI”) comprises metrics which measure Institutional Relationship Quality and Overall Coverage (i.e., “People”) Quality. Institutional Relationship Quality factors include “Effective Senior Management Support,” “Ease of Doing Business,” “Willingness to Lend,” “Most Competitive Pricing,” and “Ability to Communicate Upfront on KYC Requirements.” Coverage Quality factors include “RM’s Proactive Provision of Advice,” “Knowledge of Transaction Banking Needs,” “Knowledge of International Needs,” “Frequency of Visits,” “Timely Follow Up on Requests,” and “Effective Coordination of Product Specialists.” Study participants were then asked to rate their banks in 14 product and service categories. From September to November of 2018, Greenwich Associates conducted 149 interviews in large corporate banking with companies in India. Subjects covered included product demand, quality of coverage and capabilities in specific product areas.