Asia and its bond markets are different from the rest of the world. This diversity of large-scale economies influences the structure of the regional financial system and the uptake of electronic trading. Local economies are relatively large, and each has a relatively sophisticated financial system with large banks, insurers, corporate treasuries, asset management firms, as well as large state banks and funds, which play less of a role in the West.

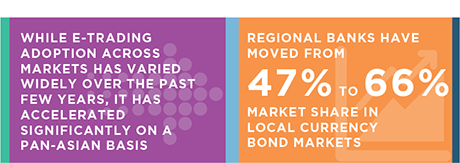

These firms have local knowledge, and recent banking reforms have further strengthened them against global competitors. The lack of regional integration or adherence to global best practices makes it difficult to scale beyond their home markets, however. These factors, in turn, influence the speed of adoption of electronic trading, which has been halting until the past few years.

E-trading may well be a tool that regional firms can leverage to gain scale and to unite the region’s capital markets. As the global e-trading platforms expand in the region, they bring with them a uniformity that aligns with global best practice and helps to interconnect the region as well as connect it with markets around the globe.

MethodologyBetween May and July 2018, Greenwich Associates conducted 785 interviews with fixed-income investment professionals at domestic and foreign banks, private banks, investment managers, insurance companies, hedge funds, corporations, central banks, and other institutions throughout Asia (ex-Japan). Countries and regions where interviews were conducted include Australia, China, Hong Kong/Macau, India, Indonesia, Malaysia, New Zealand, the Philippines, Singapore, South Korea, Sri Lanka, Taiwan, and Thailand. Interview topics included electronic trading activity, trading practices and market trend analysis.