Greenwich Associates projects that institutional investments in liquid alternative ETFs will more than double in the next 12 months. That projection is based on feedback from 107 senior fund professionals at large U.S. institutions participating in a recent study commissioned by IndexIQ.

This Greenwich Report presents the complete results of that research, including benchmark data on how institutions are currently employing both alternative asset classes and ETFs in their portfolios, and an analysis of how and why institutions are adopting liquid alternatives— and liquid alt ETFs in particular—as a means of obtaining exposures to hedge funds, real estate, private equity, and other asset classes.

One of the key conclusions drawn from this research is that liquid alt ETFs are still in their very early stages in the institutional marketplace. Drawing on data on institutional demand for alternatives classes and adoption rates of ETFs in other asset classes, the paper projects a trajectory of further long-term growth for liquid alt ETFs in institutional portfolios.

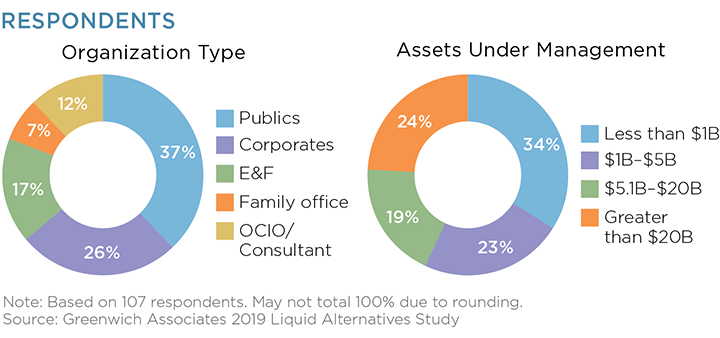

Between April and June 2019, Greenwich Associates conducted in-depth telephone interviews with 107 senior fund professionals at large U.S. institutions. Study participants included public funds, corporate funds, endowments and foundations, and family offices, as well as representatives from OCIOs and consultants.