Wednesday, May 12, 2020 Stamford, CT USA — As problems with the application process for Paycheck Protection Program (PPP) loans have subsided, banks should start bracing for another massive wave of unintended consequences.

More than one in five small businesses and one in seven middle market companies indicate they are likely to switch banks as a result of how these banks performed during the COVID-19 crisis. With 30 million small and mid-sized businesses in the U.S. that means over 6 million businesses could switch providers.

Many companies are considering a switch because of a bad experience with their bank during the PPP application process according to a Greenwich Market Pulse conducted April 30 to May 4, 2020. Approximately one-third of small businesses and 28% of middle market companies rated the application process as below average or poor. Only one-third of businesses applying for these loans rated the application process as excellent or very good.

Major frustrations business owners faced include:

- Confusing application process and unreliability of online systems

- Poor communications relating to loan approval, status, and forgiveness terms

- Concerns that banks were more loyal to their larger, more important borrowing customers

- Lack of responsiveness and weak customer service

Bank performance has been mixed during PPP, as some banks did well while others seemed to struggle,” said Steve Busby, CEO of Greenwich Associates. “But it’s clear that the frustration from some companies and business owners has driven them to the switching point. If business owners did not know what it meant to be a borrowing customer or have loyalty from their bank, they do now.”

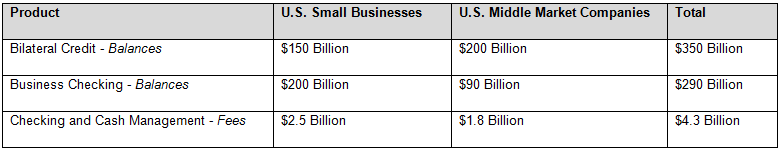

The business volumes associated with these levels of switching are massive, based on Greenwich Associates revenue data for commercial banking products and services:

Poor PPP Performance Damages Bank Reputations

Companies’ opinions of banks have been negatively impacted by the PPP application process:

- 29% of small businesses said their opinion of banks has worsened due to PPP, while only 13% said their opinions improved. Sentiment for 58% businesses remains unchanged.

- 21% of middle market companies said their opinion of banks has worsened due to PPP, while only 13% said their opinions improved. Sentiment for 65% companies remains unchanged.

As a result, there will be winners and losers among banks in coming months, depending upon how they performed during PPP. “Given the huge amount of money that will be in motion, the post-COVID recovery period will be a great time for certain banks to play offense and gain market share," said Steve Busby. “But the banks who have struggled will need to play defense since these share gains will come at their expense.”