Table of Contents

The COVID crisis turned the trading world on its head. Amid unprecedented volume and volatility, the financial industry also undertook a revolutionary move to adapt to COVID by moving nearly the entire workforce to work from home. One area that received heightened attention during the crisis was the use of outsourced trading desks.

As we now begin the process of returning to the office (or not), firms are examining what did and didn’t work during the height of the crisis, including any experience with outsourced trading.

Accelerating Trend

Although it is a somewhat overused phrase, 2020 has been an unprecedented year—from a continent on fire in January, to a pandemic starting shortly thereafter, to protests for social justice, the world has been a very unsettled place. For the financial industry, wild swings in the markets, including dislocations within and among asset classes, have added fuel to the fire. Moreover, the industry made unbelievable strides in its efforts to move to a work-from-home (WFH) environment in an incredibly compressed time frame. Although not without the occasional misstep, the stability and resiliency of the markets have been profound.

As firms expanded their remote footprint, they had to reexamine their access to their clients, counterparties and the markets themselves. A result of that evaluation may be to consider the use of outsourced trading desks. In a post-COVID world, firms are reviewing their ability to access markets in turbulent times. Outsourced desks may well fit as a supplement for current operations, in particular where a firm lacks current expertise or relationships. In a business environment where every dollar spent is highly scrutinized, some buy-side firms may find savings in the use of an outsourced trading desk. The one-stop-shop impact of outsourced trading certainly carries an expanded cachet in today’s new normal.

Evaluating the Options

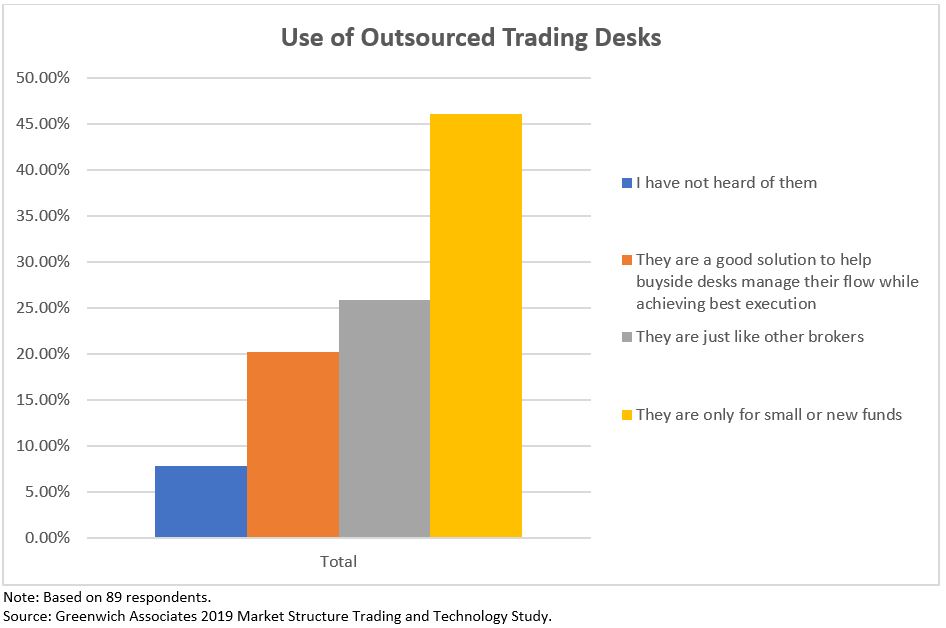

Outsourced trading, put simply, allows buy-side firms to “rent” a trading desk with the scale and capabilities that otherwise would be too expensive or too difficult to operate themselves. Our data shows that the buy side is still coming to grips with both what outsourced trading really is and how best to use it (if at all). Close to 10% of the firms in our 2019 Market Structure Trading and Technology Study were not aware of outsourced trading as an option. Nearly 72% of firms think of outsourced trading as either being the same as other trading options (e.g., agency brokerage) or more suited to smaller or newer funds. That said, more than 20% recognize outsourced trading as a good solution for today’s buy-side firms.

When a firm considers outsourcing, the next issues to tackle are 1) How would outsourced trading be used and 2) Where would outsourced trading help the most?

Outsourced trading can follow several different models. It can be a full-service desk, which provides all the connectivity, management and regulatory services of an internal desk. These firms also often trade in their own name, providing an additional level of anonymity for the buy-side firm. Of course, the institution may want to trade in its own name, whether for risk management or for sell-side credit purposes, and outsourced trading firms can accommodate those requirements as well. In some cases, the buy side may want to decide which model to use—whether case by case, asset by asset or geography by geography—and hybrid, outsourced solutions are also available to meet this need.

When evaluating whether outsourced trading will be useful, firms need to decide where they may need the service. Some need access and support in geographies beyond their current reach. Others need specialized expertise in complex assets. Still others may covet the favorable rates of an outsourced firm that consolidates flow from many institutions. As previously noted, a desire for anonymity may drive some volumes through outsourced providers. Buy-side firms may also wish to dip their toe in the waters of an asset class or geography without building an entire desk. Outsourced trading firms offer a ready-made solution for these situations.

The recognized difficulty and cost of establishing new trading desks may help explain why a swath of the industry thinks of outsourced trading in that context. Post-COVID, firms are also reexamining their ability to access markets in all manner of market conditions. With staff spread across the globe in WFH settings, the ability to use an outsourced desk to supplement their own access is understandably appealing.

Outsourced Trading and BCP/DR Requirements

Of course, as with all vendor solutions, it’s incumbent on the user to understand the downstream capabilities of the outsourced desk to handle business continuity plan (BCP) and disaster recovery (DR) requirements. The worst-case scenario would be a firm putting its trading in the hands of an outsourced provider and then having that provider fall down under stress. Following best practices for vendor evaluation is critical when entrusting a third-party with such inherently sensitive matters, particularly with regards to cyber security, resiliency and communication. To be clear, in our discussions with the industry, we have not heard of any such travails. However, the burden of fully understanding the vendor capabilities remains with the firm selecting the outsourced trading desk.

Buy-Side Trading Post-COVID

As the world slowly reopens, a thorough and diligent review of how each firm handled the COVID crisis is required. Such reviews could examine the potential role of outsourced trading in a firm’s overall trading solution—to complement, supplement or expand current capabilities.

Some may worry that outsourced trading desks add a layer of intermediation between the institution and the ultimate source of liquidity. While this can be a factor, the best outsourced trading desks partner with their clients as an extension of the buy-side firm. Others worry outsourced trading will replace all buy-side desks. In our view, there will always be a need for sophisticated traders that understand the intricacies of their own firm’s investment process. Moreover, some firms will always want to retain primary control over their trading methodology, thus limiting (or eliminating) the appeal of using outsourced desks.

In the end, each firm should review how it responded during the current crisis. Where such reviews highlight areas for improvement, the assessment of how they can be addressed may include the use of an outsourced trading desk. By no means is outsourced trading a panacea for all the world’s ills. But it is another arrow in the buy-side’s quiver to help make sense of this mad, mad world.