Corporate bond markets have proven to be one of the biggest financial technology innovation stories of the past five years. Trading protocols, data access, data quality, analytical tools, and collaboration technology have all helped the market move from what was seen as old fashioned to one in which expectations of change have driven fintech valuations to new heights.

While this move to digital has played out globally, European market participants have lagged their U.S. peers in adopting new ways of working. While several years ago the newest tools and liquidity pools were primarily made available to U.S. markets, that is not the case today. Ironically, the percentage of market volume executed electronically in Europe has always been and remains higher than that in the U.S. Nevertheless, Europe- and U.K.-based buy-side traders still largely rely on traditional RFQ trading and indicative pre-trade data.

Our research and examination of trading behavior suggest this is finally starting to change. Real-time evaluated bond prices and available post-trade data have improved, use of all-to-all trading mechanisms is starting to increase by dealers and the buy side alike, and automation of the trading process from pre- to post-trade is starting to take hold. The goal of these changes is not to shrink desk sizes, but to improve efficiency and, in doing so, execution quality and fund returns—both of which are as important as ever.

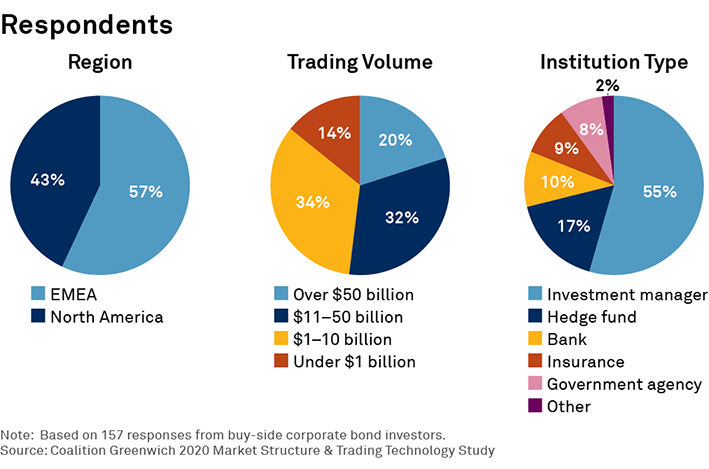

MethodologyThis research is based on interviews with 157 corporate bond investors in Europe and the United States in the fourth quarter of 2020. Respondents included asset managers, hedge funds, regional banks, insurance companies, and government agencies. Questions focused on trading activity, protocols used and expectations for change in the next one to three years.