At the end of 2020, Coalition Greenwich took a close look at the impact of the COVID-19 crisis on foreign exchange (FX) markets. In that analysis, we noted a flight to safety within the G10 currencies and a flight away from emerging markets (EM) currencies.

Also, due to corporations having to resort to drawing down their revolving credit lines in order to maintain liquidity throughout the mandated shutdown, there was a significant tightening in short-term lending markets.

Nevertheless, FX markets continued to function, with market makers staying active (although quoting wider spreads) and electronic execution platforms demonstrating their resilience despite spikes in activity. In this report, we examine the trading preferences of financial institutions and corporations in order to identify changes in behavior that will continue beyond the depths of the crisis.

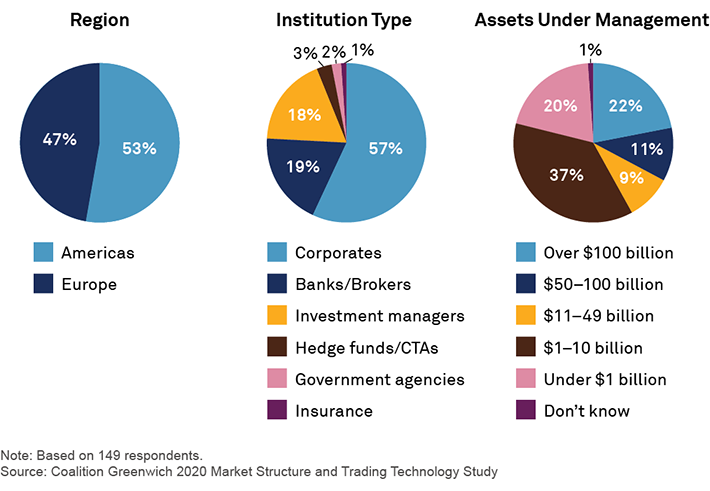

MethodologyIn Q3 2020, Coalition Greenwich interviewed 149 FX traders as a part of its annual Market Structure and Trading Technology Study. Respondents were asked a series of qualitative and quantitative questions examining their trading behavior, usage of execution platforms and the tools used to manage their workflows.