Table of Contents

Continuing effects of the COVID-19 crisis have contributed to increased levels of manager turnover that could have lasting impacts on the institutional asset management competitive landscape in Asia.

At first glance, it might seem like the 2021 market environment for asset managers competing in Asia reverted quickly to that of the pre-pandemic era. Institutional assets under management (AUM) rapidly returned to their long-term growth trajectory, as did the pool of assets outsourced to external managers. However, dislocations caused by the global pandemic continue to roil the industry, with higher levels of manager switching and terminations altering the competitive landscape.

In these volatile conditions, institutional investors are turning to managers with a commitment to providing the highest levels of client service and investment know-how. At the top of that list is PIMCO, the 2021 Greenwich Quality Leader in Overall Asian Institutional Investment Management.

Return to Growth Trajectory

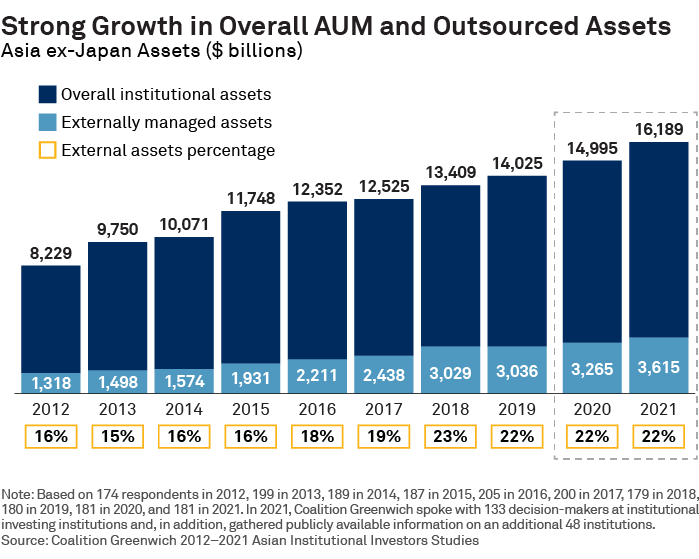

AUM by Asian institutions grew by 8% last year, to $16.2 trillion. That growth was fueled by a healthy combination of dovish central bank policies driving asset values and continued new assets being invested. The pool of assets allocated to external managers grew at 11%, outstripping total asset growth and keeping the share of outsourced assets at about 22%. (China accounts for about $6.8 trillion, or roughly 40%, of total AUM, but only $1.2 trillion, or approximately 30%, of outsourced assets.)

Across Asia, the number of asset owners managing these assets and coming to scale continues to grow as well, diminishing market concentration and broadening the potential client base for asset managers competing in the region. As recently as 2016, the top 15 institutions in Asia controlled 84% of the region’s AUM. By 2021, that share had shrunk to 62%.

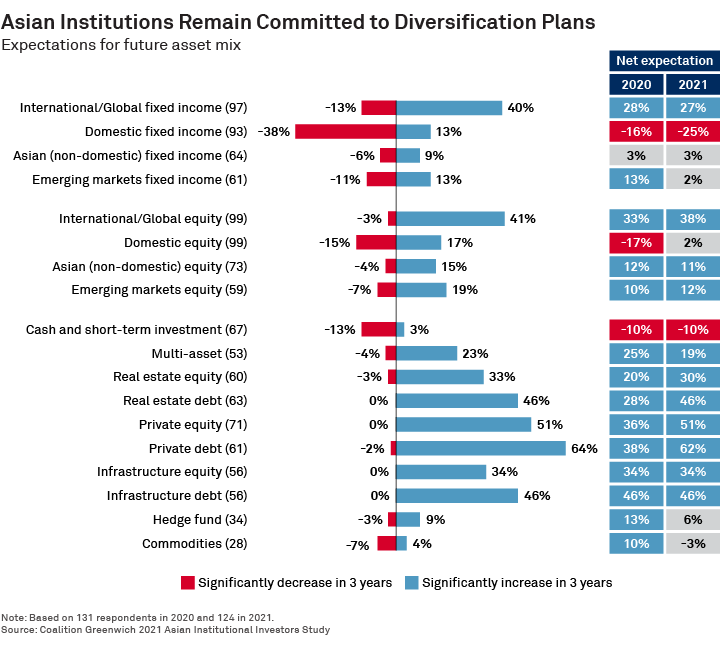

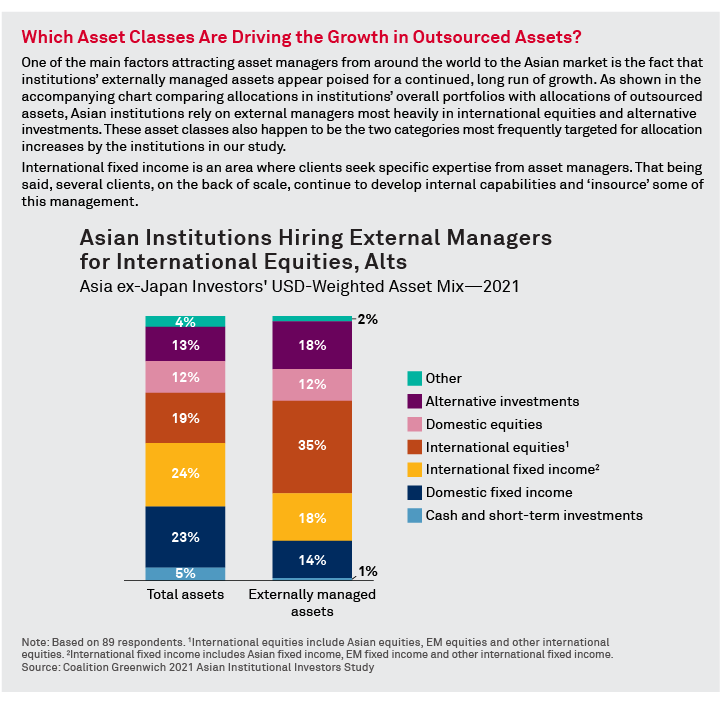

Also creating opportunities for managers is the continued diversification of Asian institutional portfolios. As institutions grow, they are reallocating assets from the domestic fixed income that, in the past, accounted for a sizable share of AUM, moving them into international assets and alternatives. Almost 40% of Asian institutions plan to make significant cuts to domestic fixed-income allocations over the next three years, compared with only 13% expecting increases. Meanwhile, as the following graphic illustrates, institutions remain firmly committed to plans to increase allocations to international fixed income and equities, and to a broad range of private and alternative assets.

As they diversify, institutions also remain committed to increasing the share of assets outsourced to external managers with expertise and capabilities in targeted asset classes. Looking ahead, institutions expect to issue the most mandates in global equity, private equity, global aggregate bonds, and infrastructure debt.

COVID Consequences

Dislocations caused by the COVID-19 crisis have elevated manager turnover to unprecedented levels. In 2021, 36% of Asian institutions reported terminating a manager in the prior 12 months. That’s a firing rate not seen in this market in a long time. At the same time, 85% of institutions say they switched managers over that period, representing a five-year high. Those terminations and switching rates are often a consequence of COVID-related changes in behavior. In some cases, this turnover reflects disappointment among Asian institutions in the performance, client service or support they received from existing managers during the crisis. Terminations and switches can also be the result of changes in strategies or policies made by institutions faced with operational and market disruptions.

Whatever the cause, this “churn” is creating vast new opportunities for asset managers looking to pick up new clients and assets—especially those who proved themselves reliable during the crisis. At the top of that list is PIMCO, the 2021 Greenwich Quality Leader in Overall Asian Institutional Investment Management.

Relative to its competitors in the region, PIMCO had some natural advantages during the crisis. First, its position as perhaps a preeminent fixed-income specialist put the firm in a strong position at a time when specialization and quality made a material difference to clients. PIMCO’s strong brand, size and global footprint made it a natural choice for institutions in need of a manager at a time when in-person due-diligence visits were impossible. In addition, the firm’s excellent client service put it in a position to capitalize on client opportunities.

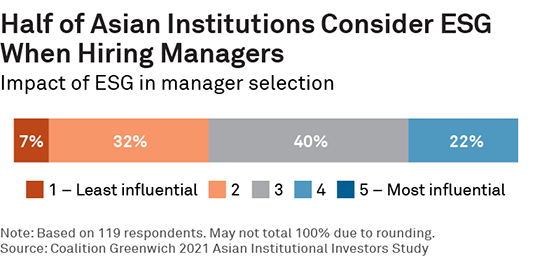

ESG Playing Bigger Role in Manager Selections

Another lasting consequence of the COVID-19 crisis might be the increased influence of environmental, social and governance issues on the Asian institutional asset management industry. Despite pandemic obstacles, the share of institutions reporting that they consider ESG factors to at least some extent in manager hirings increased to 51% in 2021 from 42% in 2020. With so many Asian institutions employing ESG standards in manager selection, the sheer volume of manager turnover caused by the pandemic is embedding ESG more deeply in the industry and ensuring that managers hoping to expand their presence in Asia must commit to robust ESG policies.

Relationship Director Parijat Banerjee and Relationship Manager Arifur Rahman advise on the investment management market in Asia.

MethodologyBetween January and March 2021, Coalition Greenwich conducted 133 interviews with senior decision-makers at the largest institutional investors in Asia ex-Japan. Senior fund professionals were asked to provide detailed information on their investment strategies, quantitative and qualitative evaluations of their investment managers, and qualitative assessments of managers soliciting their business. Countries and regions where interviews were conducted include Bangladesh, Brunei, Cambodia, China, India, Indonesia, Hong Kong/Macau, Malaysia, Pakistan, the Philippines, Singapore, South Korea, Taiwan, and Thailand.