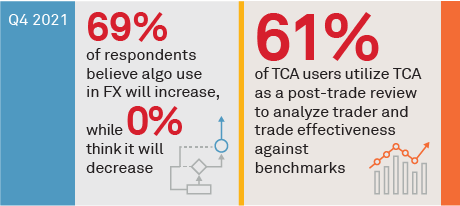

The use of algorithms in foreign exchange (FX) execution remains less prevalent than in equities. Market practices change over time, of course, and disruptions such as the pandemic then accelerate those trends already in motion. Technology advancements in the overall FX market, including new execution strategies and more accurate transaction cost analysis (TCA), positively reinforce each other. There is a long-standing question in FX concerning the use of algos to execute trades. The FX market has been steadily adopting algos, and we expect that to continue. While some motivations to use algos remain consistent (e.g., accessing liquidity), there are new drivers that are changing this part of the market.

MethodologyIn Q2 2021, Coalition Greenwich interviewed 80 FX traders globally as a part of its annual Market Structure & Trading Technology Study. Respondents were asked a series of qualitative and quantitative questions examining their trading behavior, usage of execution platforms and the tools used to manage their workflows.