Table of Contents

Municipal bond markets are ripe for increased automation. The buy side wants better access to liquidity and more transparency, and the dealer community increasingly sees the value of providing electronic liquidity utilizing pricing models that have been refined even more through the pandemic and, more recently, inflation-driven volatility. More electronic trading. Improved pre-trade transparency. Greater use of auto-quoting. Better front-to-back trading workflows. It won’t all come at once, and much of it hasn’t come yet, but it’s coming.

Market Roller Coaster

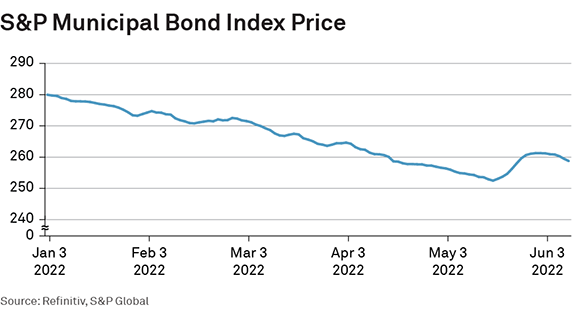

Municipal bond prices have been on a roller coaster over the past two years along with the rest of the U.S. bond market. As of this writing in mid-June, the S&P Municipal Bond Index was down 8% since the start of 2022, an almost unprecedented decline in a 6-month period. Corporate and government bond markets have been hit even worse.

But amid this volatility, the municipal bond market hasn’t managed to capitalize on the digitization tail-wind created by the corporate bond and U.S. Treasury markets. Electronic trading in the U.S. corporate bond market has doubled since the start of 2019, and the U.S. Treasury market is back up near its historic e-trading peak. Yet, e-trading in the muni market has barely budged.

Muni Bond E-Trading

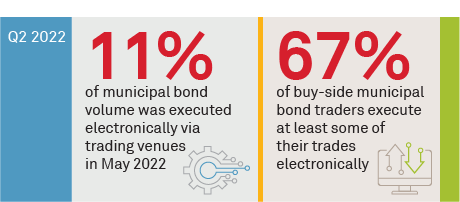

In a Coalition Greenwich report published in the first half of 2019, we estimated that 12-15% of municipal bonds were traded electronically. Examining volumes published by MarketAxess (including its MuniBrokers) and Tradeweb, and Coalition Greenwich estimates of the volume handled by Bloomberg and ICE Bonds (formerly known as TMC and BondPoint), we estimate that platform e-trading levels haven’t budged in the past three years, still sitting at roughly 11% in May 2022.1 E-trading between dealers and their clients directly would up that number slightly, but ultimately 2022 is still largely in line in 2019.

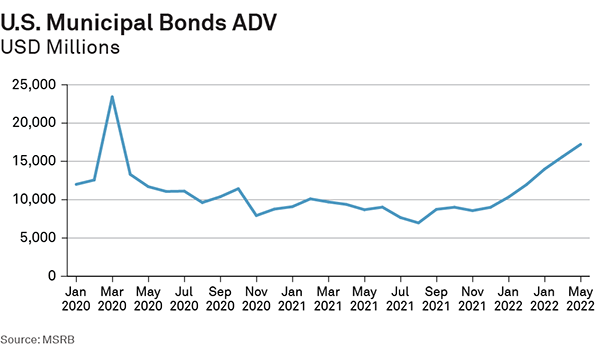

And while overall market volumes in March 2020 ($23.4 billion) and the second quarter of 2022 ($16.4 billion in April and June) jumped on market volatility, average daily volumes (ADVs) over time still sit where they were as far back as 2009 ($11 billion). This means that the muni market can’t even claim absolute e-trading gains despite the relative percentage remaining unchanged.

Buy-Side Demand

Looking ahead over the next three to five years, however, progress feels inevitable. Coalition Greenwich data shows that roughly two-thirds (67%) of buy-side muni bond traders executed at least some of their volume electronically in 2021. While this was down slightly from a pre-pandemic 69%, it was a few ticks up from 65% in 2020. Our data also shows that muni investors worked with an average of 11 dealers in 2021, up 3% from the year before. Gathering competing quotes on individual orders is, of course, more efficiently done on the screen.

![Corporates and taxable munis [for me] all go through MarketAxess](/sites/default/files/images/Reports/Greenwich-Reports/Markets/GR/2022/22-2024-MarketAxess-Munis/Quote2.22-2024.png)

We have, of course, seen this story play out before in both U.S. Treasuries and U.S. Corporate Bonds. U.S. Treasury markets began their electronification journey in the late 1990s, where dealer-to-dealer trading was the first to move onto the screen. Fast forward to today, and nearly 70% of the total market trades electronically, including 57% of dealer-to-client trading (as of May 2022).

The corporate bond market transformation in the past decade has been arguably even more dramatic. In May of 2018, 19% and 8% of investment-grade and high-yield bonds traded electronically. Four years later, in May of 2022, the percentage for investment-grade bonds has more than doubled to 41% and more than tripled for high-yield bonds to 28%.

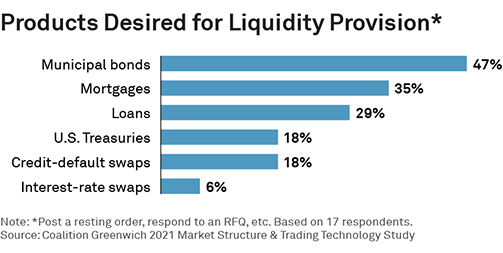

Corporate bond and Treasury markets started their path to investor e-trading via RFQ platforms, which eventually took us to the streaming, all-to-all and auction options we now have today. And while all of these markets have different investing and trading dynamics, muni markets still have the benefit of knowing what worked and didn’t work elsewhere, which might ultimately help it progress more quickly going forward. When we asked buy-side fixed-income traders what products other than corporate bonds they would like the ability to provide liquidity in, municipal bonds was the top answer. This suggests that appetite does exist for the all-to-all style markets that are now common elsewhere. To that point, almost three-quarters of tax-exempt municipal bond volume on MarketAxess is executed via Open Trading.

Dealer Opportunities

Of course, dealers are often reluctant to risk their revenues by encouraging the use of tools that will create more competition for their services. Coalition Greenwich data shows that the top 12 global dealers made $2.7 billion in revenues from their municipal bond businesses in 2021 (not including debt capital markets revenue), up 27% from 2020. However, three recent acquisitions demonstrate the dealer community’s belief that opportunity exists in muni-market automation:

- In February 2021, InCapital (a fixed-income underwriter and distributer) merged with 280 Capital Markets, whose e-trading platform aggregates data and allows for execution across multiple municipal bond and corporate bond markets.

- In July 2021, TD Bank acquired Headlands Tech Global Markets. Headlands is well known among muni market structure watchers as one of the pioneers in automated muni bond market making.

- In March 2022, Raymond James bought fixed-income electronic market maker SumRidge. While SumRidge is more known for their trading in corporate bonds, the bet by Raymond James, who is a big player in munis, talks to their path forward.

Munis Are Different

It is not lost on us that the municipal bond market is in fact quite different than other U.S. corporate and government bond markets. The roughly 1 million outstanding bond issues alone mean that the vast majority of those bonds will be illiquid, with many never trading after they are issued. And the market is by definition regional, with investors often looking for bonds issued in their own state to gain the tax advantages, and broker-dealers in that state often handling an outsized proportion of trading in those bonds.

But as interest rates continue to rise, demand for munis, both tax-exempt and taxable, will increase among retail and institutional investors alike. We have, for instance, already seen muni ETF trading volumes jump dramatically. Data from Jane Street shows that ADVs have hit $1 billion in Q2 2022, up from roughly $200 million per day in 2021. While the dynamics between ETFs and the underlying assets are different in every market, the growth of credit ETFs ultimately proved a huge catalyst to increased corporate bond e-trading and the entry of new electronic market makers into the space.

The bottom line: Change is coming. Dealers are getting better at auto-pricing. Clients and dealers alike are much more apt to trade via new mechanisms (e.g., auctions, anonymous RFQ, etc.). And the vast majority of market participants we speak with point to a focus on workflow efficiency and automation in the years to come.

Corporate bond market electronification was a slow burn until the financial crisis, and then 12 years later the pandemic turned on the after burners. Has the fire now been set for muni markets to take the same path? We sure hope so.

Kevin McPartland is the Head of Research for Market Structure and Technology at Coalition Greenwich.

1The estimate includes both taxable and tax-exempt municipal bonds, and trading activity from Bloomberg, ICE, MarketAxess and Tradeweb.

MethodologyThis research is based on interviews with 17 buy-side fixed-income traders in Q4 2021. Municipal bond experts at trading venues, market makers and broker-dealers were also interviewed to provide additional market color. Data sources include Coalition Greenwich estimates, MSRB, S&P Global, MarketAxess, and Tradeweb.