Corporate bond new issuance is trending downward, following an absolutely blockbuster year in 2021 and a stronger than anticipated Q1 2022. While this expected lull in the action isn’t good news for syndicate desk revenues (Coalition Greenwich data shows that debt capital markets revenues at the top 12 banks are down 24% from Q1 2021 to Q1 2022), it has created an opportunity for the market’s largest participants to drive forward much-needed technological and process improvements for the corporate bond new issuance process.

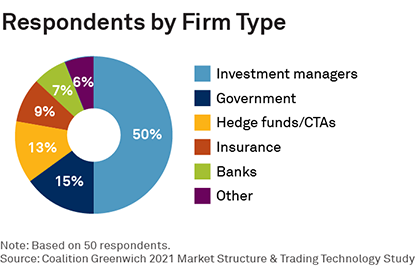

MethodologyBased on interviews with 50 U.S.-based buy-side fixed-income traders in Q1 2022. Topics discussed include the impact of technology on the corporate bond new issuance process, perceptions of new issuance platforms and expectations for tokenization of the new issuance process in the coming years. Respondents worked for investment managers, hedge funds, government agencies, and other buy-side firms.