Client requirements for asset management in Japan have continued to evolve rapidly in the last three years, driven by several business, macroeconomic and geopolitical factors.

- There continues to be ongoing, if quiet, substitution of active mandates into passives, driving down the economics of managers focused mainly on actives.

- Besides moving to passives, institutions are making a significant shift toward private assets to balance their overall portfolio return generation.

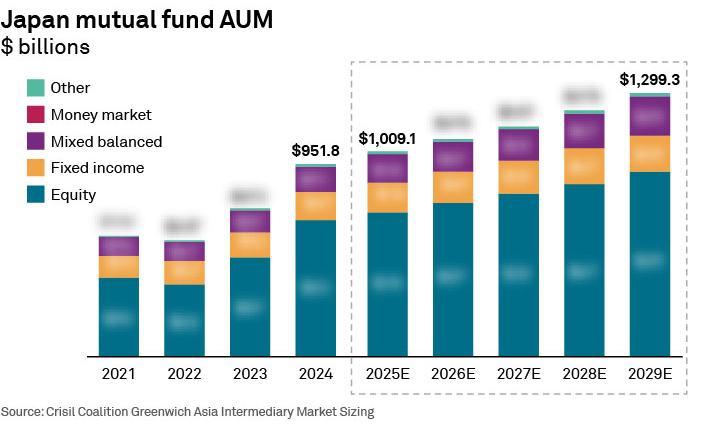

- Despite softer fund flows in recent months, Japan’s mutual fund market is projected to surpass US$1 trillion in total assets this year. This growth is underpinned by structural changes, including tax reforms and the transition from DB to DC pensions. Within this broader trend, retail investors are increasingly reallocating into equity funds, particularly through NISA accounts. These dynamics favor managers with the right product lineup and a strong grasp of key distribution channels for high-net-worth and retail clients. Crisil Coalition Greenwich sizes the Japan retail fund market regularly as part of our Asia Intermediary Market Sizing research, providing data-driven insights into product trends, distributor activity and competitive positioning.

- Short-to-medium term macroeconomic factors, such as the buoyant Japanese equities markets and growing interest in Japanese government bonds as a safe-haven asset, given the volatility in U.S. Treasuries, give an advantage to managers who have stronger capabilities in these asset classes.

Domestic managers gaining ground over international peers

Crisil Coalition Greenwich speaks to about 250 institutional investors and about 100 Japanese retail distribution partners each year. Through these conversations, we see a clear reversal in the positioning of Japanese managers versus global managers operating in Japan.

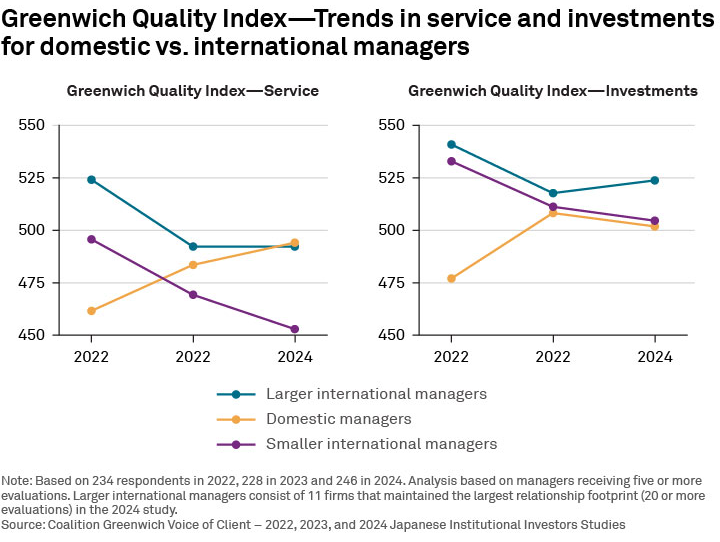

International asset managers for traditional assets (public fixed income, equities, multi-asset, money markets, etc.) who, up to 3 years ago, were setting the standards with the strength and depth of their relationships with Japanese clients, have fallen behind Japanese managers. In several key measures of strategic relationship management—from understanding clients’ goals to relationship management capability and credibility with investment committees—domestic Japanese managers now outpace their international peers.

While investment performance is usually judged independently and more quantitatively by clients, we see clients’ view of investment capabilities and performance of global managers also flagging compared to domestic firms. This is likely driven by changes in product mix requirements, which are strengthening the hands of the domestic managers., as well as challenges facing global managers, in terms of senior bandwidth devoted to product development and client coverage, in a climate where business economics remain challenged compared to the past. Smaller international managers have been hit particularly hard, while the very large international managers have been able to leverage business scale and product breadth to ride out the headwinds. We see managers take different approaches in this setting.

Opportunities for both domestic and international managers

Domestic managers continue to act on opportunities where competition from international peers is lower, while also using this period to recalibrate their investment and research capability in listed and private Japanese equities to address increasing overseas demand for investments into Japanese assets.

Larger international managers have the opportunity to refine their sales strategy to address Japanese clients’ changing needs. This has accelerated with detailed knowledge of client demand by sub-segments and regions within Japan. Their established brand strength as well as, in some cases, alternative assets capabilities, get them a seat at the table for most mandates, with most large managers vying for a strategic advisor relationship with key Japanese clients.

Smaller international managers need to become much more targeted in client selection in the short term, with clear knowledge of the target asset allocation of clients and the competition level within each client. They also need to build a data-driven view of product demand and a product development roadmap for the medium term.