Table of Contents

Many global banks have pulled out or scaled back their coverage of Asian local currency bonds, leaving these fastgrowing markets largely in the hands of a few committed global banks like HSBC and Standard Chartered Bank and up-and-coming domestic firms. Going forward, most global banks will be centering their focus on G7 rates and G3-denominated Asian products as they work to better penetrate the larger Asian markets as well as significant offshore emerging markets investors in the U.S. and Europe.

Domestic Currency Reversal

Not long ago, local Asian bond markets were seen as an attractive source of long-term growth by most of the world’s largest fixed-income dealers. In the past two years, however, several European banks with a significant presence in Asian bond markets essentially exited core parts of the fixed-income business in the region as part of broader corporate restructurings. Meanwhile, other prominent global banks shifted gears and reduced their coverage of local currency markets to focus on G7 rates and credit products.

These changes have reduced capacity in Asian local currency bond markets and created opportunities for dealers who remain committed to the business to win new market share. Among the global banks, the prime beneficiaries have been HSBC, which leads all dealers with a 12.8% market share in domestic currency Asian bonds, and Standard Chartered, which leapfrogged other global banks last year to capture the second spot with an expanding market share of 8.2%.

“From the dealers’ perspective, maintaining a franchise in domestic currency Asian bonds is a very expensive, and very capital-intensive proposition,” says Greenwich Associates consultant Abhi Shroff. “Given new capital reserve requirements and balance sheet pressures, many banks that are not leaders in these markets have decided that it doesn’t make sense to try to build or expand their presence now. As a result, the dealers that have already made sizable investments and have strong capabilities will find themselves facing much less competition from their global rivals.”

Of course, global banks do face real competition in these markets from domestic banks including KDB Daewoo Securities and Woori Investment & Securities in South Korea, ICBC, Bank of China and CITIC Securities in China, ICICI Securities and Axis Bank in India, and CIMB and Maybank in Malaysia.

“Another dealer to watch is ANZ, which is gaining momentum in Asian rates and currency in both G3 and local currency products,” says Greenwich Associates consultant James Borger.

Global Dealers Focus on G7 and G3 Products

It is important to point out that the shift in focus away from domestic currency bonds does not imply that global banks are retreating in Asia. To the contrary, these banks have built extensive operations in Asia that they are using to compete hard for business in G7-issued rates and credit and G3-denominated Asian products. “These are much more capital-efficient and attractive businesses for the globals,” explains Abhi Shroff. “Since a large number of these investors are based in Hong Kong and Singapore, it is more efficient for most dealers to cover these markets. Dealers, of course, continue to cover significant investors’ other markets, but they are largely cutting back on coverage of domestic currency products where dealers are limited on inventory. Global dealers’ sales teams have hence declined in many local markets across Asia, creating some opportunities for newcomers.”

In fact, after several years in which restructurings by global banks caused high levels of turnover in fixed-income sales teams, the marketplace stabilized considerably over the past 12 months as dealers settled into their new strategies.

Greenwich Share Leaders

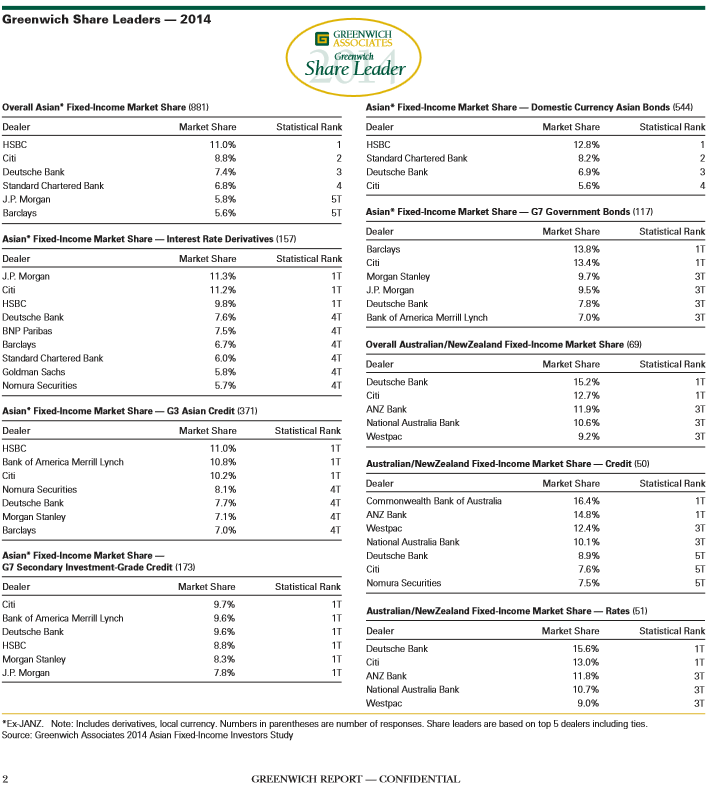

HSBC leads all fixed-income dealers in Asia (excluding Japan, Australia and New Zealand) with a commanding overall market share of 11.0%. Citi ranks second with an overall share of 8.8%, followed by Deutsche Bank at 7.4%, Standard Chartered at 6.8%, and J.P. Morgan and Barclays, which are tied with market shares of 5.6–5.8%. These firms are the 2014 Greenwich Share Leaders in Overall Asian Fixed Income.

In interest-rate derivatives, nine firms received the title of 2014 Greenwich Share Leader. At the head of this hypercompetitive market are J.P. Morgan, Citi and HSBC, which are statistically tied in market share. Deutsche Bank, BNP Paribas, Barclays, Standard Chartered, Goldman Sachs, and Nomura Securities follow in a six-way tie for fourth place.

HSBC, Bank of America Merrill Lynch and Citi are deadlocked at the top of the market in G3 Asian credit bonds with market shares of 10.2–11.0%, followed by Nomura Securities, Deutsche Bank, Morgan Stanley, and Barclays, which are in turn tied with market shares of 7.0–8.1%. These firms are the 2014 Greenwich Share Leaders in G3 Asian Credit.

With market shares of 13.4–13.8%, Barclays and Citi tie for first place in G7 government bonds, followed by Morgan Stanley, J.P. Morgan, Deutsche Bank, and Bank of America Merrill Lynch. These firms are the 2014 Greenwich Share Leaders in G7 Government Bonds.

No fewer than six dealers tie for the top spot in the secondary trading of G7 investment-grade credit with market shares of 7.8–9.7%. The 2014 Greenwich Share Leaders in this product are Citi, Bank of America Merrill Lynch, Deutsche Bank, HSBC, Morgan Stanley, and J.P. Morgan.

The 2014 Greenwich Share Leaders in Domestic Currency Asian Bonds are HSBC, Standard Chartered, Deutsche Bank, and Citi.

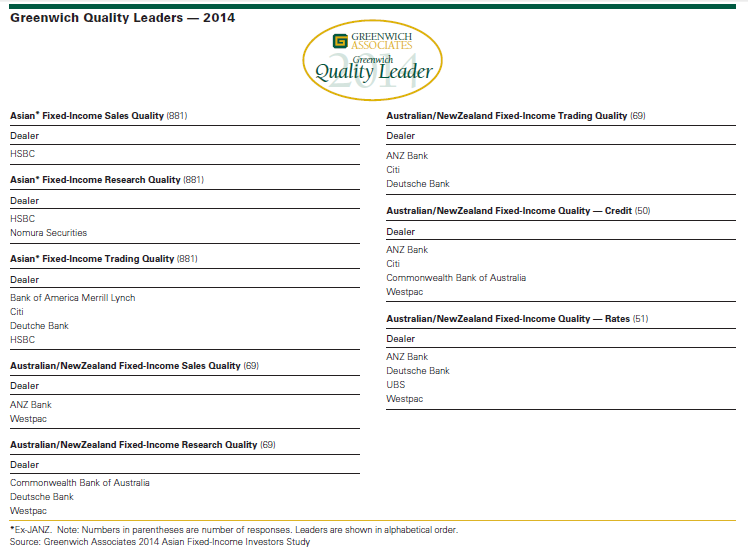

Greenwich Quality Leaders

HSBC is the clear leader when it comes to the quality it delivers to clients in Asian fixed income. Every year, Greenwich Associates asks around 900 institutional investors participating in the annual Asian Fixed-Income Investors Study to name the dealers they use for specific products, and to rate the quality of these dealers in a series of product and service categories. Dealers whose client ratings top those of competitors by a statistically significant margin are named Greenwich Quality Leaders.

HSBC claims the title of 2014 Greenwich Quality Leader in Asian Fixed-Income Sales. In Asian Fixed-Income Research, HSBC is joined as a 2014 Greenwich Quality Leader by Nomura Securities. The 2014 Greenwich Quality Leaders in Asian Fixed-Income Trading are Bank of America Merrill Lynch, Citi, Deutsche Bank, and HSBC.

Greenwich Leaders in Australia and New Zealand

The 2014 Greenwich Share Leaders in Overall Australian/ New Zealand Fixed Income are Deutsche Bank and Citi, which tie for the top spot, followed by ANZ Bank, National Australia Bank and Westpac, which are also tied in market share.

Seven dealers share the title of 2014 Greenwich Share Leader in Australian/New Zealand Fixed-Income Credit, led by Commonwealth Bank of Australia and ANZ Bank, which are tied atop the market. The 2014 Greenwich Share Leaders in Australian/New Zealand Fixed-Income Rates are Deutsche Bank and Citi, which tie for the top spot, followed by ANZ Bank, National Australia Bank and Westpac, which are also tied.

The 2014 Greenwich Quality Leaders in Australian/New Zealand Fixed-Income Sales are ANZ Bank and Westpac.

The 2014 Greenwich Quality Leaders in Australian/New Zealand Fixed-Income Research are Commonwealth Bank of Australia, Deutsche Bank and Westpac. In Australian/ New Zealand Fixed-Income Trading the 2014 Greenwich Quality Leaders are ANZ Bank, Citi and Deutsche Bank.

Consultants Abhi Shroff and James Borger advise on the institutional fixed-income markets in Asia.

MethodologyBetween April and July 2014, Greenwich Associates conducted 881 interviews with fixed-income investment professionals at domestic and foreign banks, private banks, investment managers, insurance companies, hedge funds, corporations, central banks, and other institutions throughout Asia (ex-Japan).Countries and regions where interviews were conducted include Australia/New Zealand, China/Hong Kong/Macau, India, Indonesia, Malaysia, the Philippines, Singapore, South Korea, Sri Lanka, Taiwan, and Thailand. Interview topics included service provider assessments, trading practices, market trend analysis, and investor compensation.

The findings reported in this document reflect solely the views reported to Greenwich Associates by the research participants. They do not represent opinions or endorsements by Greenwich Associates or its staff. Interviewees may be asked about their use of and demand for financial products and services and about investment practices in relevant financial markets. Greenwich Associates compiles the data received, conducts statistical analysis and reviews for presentation purposes in order to produce the final results.

© 2015 Greenwich Associates, LLC. All rights reserved. Javelin Strategy & Research is a subsidiary of Greenwich Associates. No portion of these materials may be copied, reproduced, distributed or transmitted, electronically or otherwise, to external parties or publicly without the permission of Greenwich Associates, LLC. Greenwich Associates®, Competitive Challenges®, Greenwich Quality Index®, Greenwich ACCESS™, and Greenwich Reports® are registered marks of Greenwich Associates, LLC. Greenwich Associates may also have rights in certain other marks used in these materials.

The Greenwich Quality LeaderSM and Greenwich Share LeaderSM designations are determined entirely by the results of the interviews described above and do not represent opinions or endorsements by Greenwich Associates or its staff. Such designations are a product of numerical scores in Greenwich Associates’ proprietary studies that are generated from the study interviews and are based on a statistical significance confidence level of at least 80%. No advertising, promotional or other commercial use can be made of any name, mark or logo of Greenwich Associates without the express prior written consent of Greenwich Associates.