On-chain trading and clearing set to transform collateral management

The recent, near-instant repo transaction of a U.S. Treasury asset against the USDC stablecoin on a public blockchain has set the stage for dramatic changes to collateral management—and scaling-up is not too far away, according to panelists at a Crisil Coalition Greenwich webinar, Tokenization for Trading and Clearing: Moving assets on chain for speed and efficiency.

Hosted by David Easthope, Head of Fintech Research, Market Structure & Technology, Crisil Coalition Greenwich, the panelists included key members of the consortium of market participants that enabled the fully on-chain transaction.

“What happened on one Saturday in late July is momentous to the world of financing and collateral management,” stated Kelly Mathieson, Chief Business Officer, Digital Asset. Its public blockchain, Canton Network, was used to execute the transaction outside of business hours through the Tradeweb platform.

Added Chris Bruner, Chief Product Officer, Tradeweb, “It’s the beginning of an important journey for us… We're talking about very significant change coming for many of the services around how people trade and move collateral.”

The atomic swap of stablecoins with tokenized Treasuries was “consummated in a split second,” with the trade lasting 15 minutes before being unwound and the on-chain assets burned. Glenn Barber, Head of Canton Business Development at trading firm DRW, said, “We're not necessarily trying to revolutionize finance, but what we are trying to do is make the wheels go a lot faster, spin a lot better and in a cheaper and more efficient way.”

A growing need for collateral mobility

The strategic importance of collateral has grown, with market-structure evolution demanding faster movement and more efficient use. According to Crisil Coalition Greenwich research, tokenization of collateral was ranked second (after AI) as a potential gamechanger for the derivatives clearing and trading workflow, with sell-side firms ranking it first.

On-chain to increase speed and capital efficiency

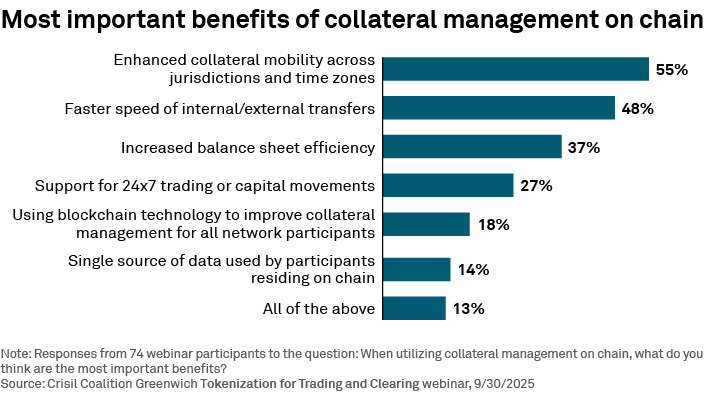

Certainly, the pilot demonstrated how moving assets on chain will enhance speed and collateral mobility—which were also the primary benefits to on-chain collateral management in an online poll conducted during the webinar. Both are key for multi-currency, multi-jurisdictional trading across time zones, which leads to cost efficiencies, according to panelists.

For DRW, tokenization can also offer more “optionality and capital efficiency,” as it can use on-chain assets to provide financing in minutes.

“The future looks bright because we're not talking about adopting new technology, we're talking about existing technology that has been improved upon to take advantage of what blockchain has to offer,” stated Barber.

Tradeweb’s customers can potentially plug into on-chain workflows as easily as adding a mobile app. “The tokenized version of a workflow or trade is just the digital rails… You don't have to do too much more than you're used to doing today,” said Bruner. Tradeweb’s ability to plug into existing ecosystem infrastructure will enable scale, and it will also extend its liquidity capabilities on-chain. “In the medium term, liquidity will accelerate and bring in the client network.”

Foundational effort

According to Mathieson, three key building blocks were achieved in conducting the on-chain repo transaction:

- Gaining access to high-quality liquid assets and being able to use them real-time 24x7

- Having an application like Tradeweb that allows financing activity outside of market hours

- Having the on-chain version of cash “so that you can have ‘atomicity’ across the full financing transaction”

Tradeweb deployed the backend to enable 24x7 trading besides connecting with Canton’s blockchain. It also went beyond adding digital rails to “jump straight to e-trading,” as it brought in order and audit trails, processes in a regulated environment. “We expect to scale these production use cases pretty quickly into next year,” said Bruner.

The Depository Trust & Clearing Corporation (DTCC) also played a key role in immobilizing the real-world U.S. Treasury asset so that its on-chain version was the only existing version. “That enabled it to move around fungibly inside the Canton Network,” said Mathieson. The Canton ledger was used to record the transaction for all parties, “which enabled it to serve as the single source of truth.”

Challenges ahead

More needs to be done, though, before on-chain trading gets productionized. For one, collateral management functionality still needs to be incorporated into the on-chain ecosystem, said Mathieson. “The transactions done so far have been done with incredibly sophisticated organizations that can support bilateral activity. But very quickly, the volume of activity will go beyond bilateral transactions.”

Hence, coordination is needed to move collateral seamlessly across different custodians, depositories or counterparties.

DRW’s Barber pointed out that legacy processes, such as onboarding, could also create points of friction and need to be simplified.

What next?

Which assets will get tokenized in the near term? And, which risks need to be addressed to enable on-chain trading?

On-chain can help make available 90% of high-quality liquid assets that are in demand but can’t be accessed currently due to various restrictions, according to Mathieson. “That will be a gamechanger.” Beyond U.S. Treasuries, she expects U.K. gilts and Eurobonds to be among the easiest assets to get on chain.

To enable this, participants must ensure the technology can “handle the scale and throughput requirements for supporting real-time transactions,” manage contractual relationships between entities, and enable data documentation, she said.

Bruner expects significant use-case expansion, and DRW is also expanding the universe of participants, trades and jurisdiction coverage. “The so-called ‘final state’ is to make this business-as-usual and integrate it into the daily workflow,” said Barber. As Bruner stated: “The pace of change is going to be very rapid.”