Table of Contents

European corporates are making the move toward allocating higher shares of trade finance relationships to global and regional banks.

Changing corporate needs means corporates are starting to focus more on banks that can provide global network, innovative digital platforms and comprehensive corporate banking offerings. In 2020, 23% of large corporates used at least one global bank for trade finance. By 2025, that share had increased to 26%—well ahead of the market penetration levels of Europe’s regional and domestic banks.

Given the maturity of the European large corporate trade finance market, competitive gains by one bank come at the expense of another. To date, both regional and domestic providers have managed to maintain market penetration levels. However, proprietary data from Crisil Coalition Greenwich suggests Europe’s domestic banks and foreign specialist banks could emerge as the losers in what is largely a zero-sum game.

Every year, we ask more than 500 large European corporates participating in our annual research to name the banks they use for trade finance, rate the service they receive from each bank, break down the share of wallet allocated to each provider, and project which banks are likely to win more or less business in the future.

In 2025, corporates in Europe provide positive “business momentum” for all 10 of the leading regional and global trade finance players. Those positive scores indicate that corporates are positioning to allocate more transaction volumes to regional and global banks in the future, thus putting the domestic banks’ and foreign specialist banks’ trade finance franchises at risk.

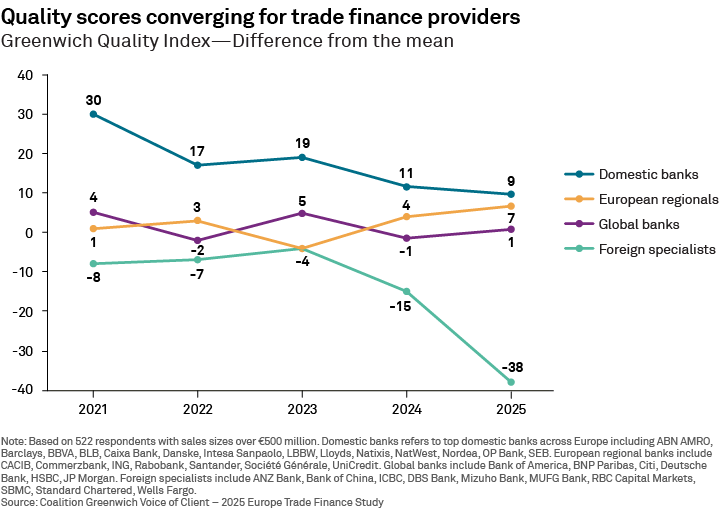

Historically, Europe’s domestic banks (i.e., national champions) have maintained a solid position in trade finance by providing a level of intensive, high-quality service to corporate treasury departments that larger competitors found tough to match. Crisil Coalition Greenwich measures bank service quality on the Greenwich Quality Index (GQI), a statistical measure calculated from quantitative ratings assigned to each bank by corporate clients. As recently as 2021, European domestic banks led global banks by 26 points on the GQI. That lead narrowed dramatically over the subsequent four years, closing to just 8 points in 2025. The gap between domestic banks and large European regional banks experienced a similar contraction (from 29 to 2).

The convergence of quality scores for banks was driven not by any huge improvement on the part of global or regional banks, but rather by a precipitous fall of some 21 points by domestic banks. How could domestic bank service quality scores have dropped so far so fast? For the most part, the decline has more to do with changes in what corporates want and need from their trade finance providers than a bank’s performance.

Domestic banks are not the only providers at risk of losing ground in European trade finance. Our data suggests that European corporates are also moving away from specialist providers, which were typically used for coverage and support in selected foreign regions and countries. Historically, European corporates rated the quality of service they receive from foreign specialists as second to only European domestic banks, but those quality ratings have plummeted over the past two years. Today, European corporates are rating foreign specialists far below domestic, regional and global banks in terms of GQI scores.

Evolving trade finance needs

As the trade finance industry and the business environment evolve, the needs and expectations of corporate treasury departments are changing. European corporates are now demanding services such as:

- International networks

- Expansive product offerings across corporate banking products that support broad relationships

- Innovative and high-quality digital platforms

International Networks

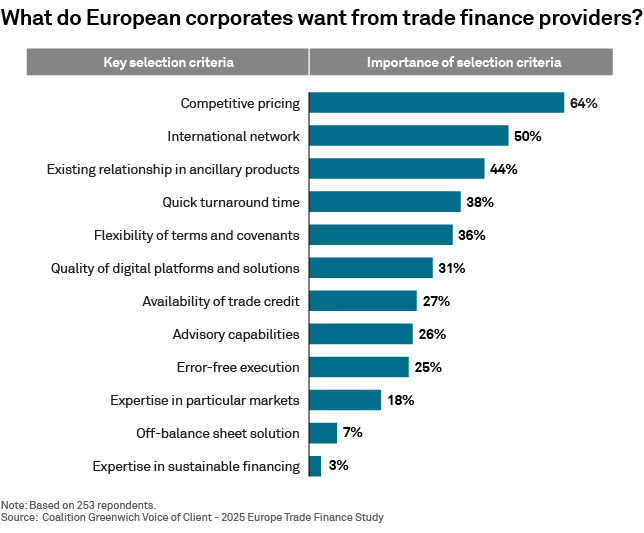

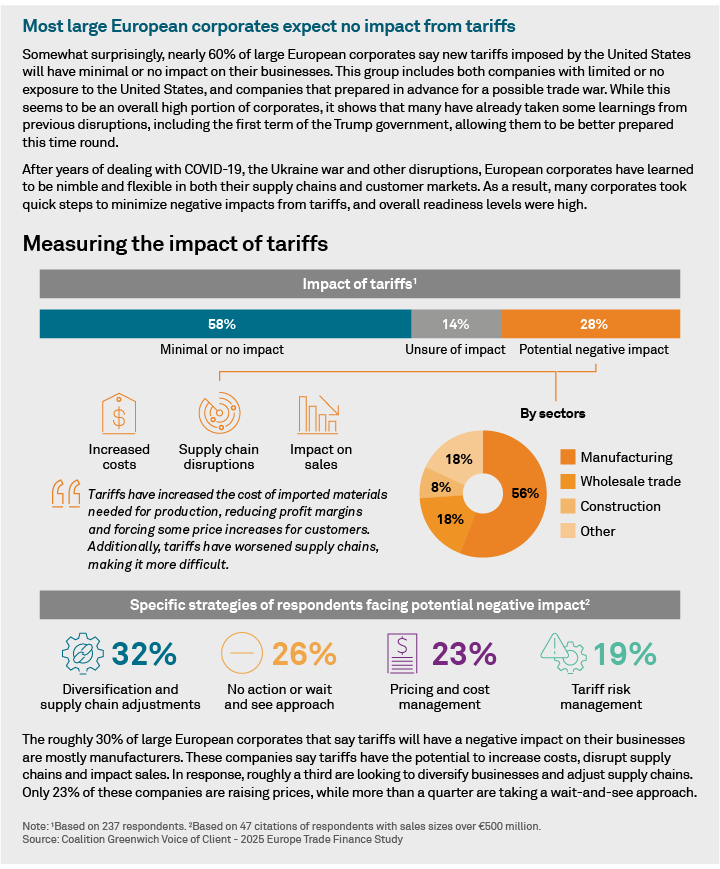

Despite slowdowns and disruptions in trade from COVID-19, global conflicts and trade wars, international trade makes up a sizable and still-growing portion of large European corporates’ business. In fact, outside of pricing, a broad international network that can support international business and operations is now the primary criterion corporates are looking for when selecting a trade finance provider. If anything, the quality of trade finance banks’ international networks has been growing in importance, as European corporates deal with the challenges and increased complexity of supply chain diversification and the need to respond to tariffs.

As shown in the graphic above, there is significant divergence in the importance corporates give to international networks. In the eyes of corporate treasury departments, some banks come to the table with extensive international networks, while others do not. In many, if not most, cases, it is domestic banks with limited geographic reach that fall into the latter category. This is one of the reasons why corporates have started to incline toward global and regional players.

Expansive product offerings across corporate banking products that support broad relationships

As recently as 2019, only 21% of European corporates cited existing relationships in ancillary products as a key factor in selecting a trade finance provider. By 2025, that share had jumped to 44%. In other words, even in a period of relatively high credit availability, more corporates are directing their fee-based transaction banking services—such as cash management and trade finance—to the banks they already rely on for credit and other corporate banking needs. This trend likely reflects strategic adjustments by banks themselves, which, in response to higher capital requirements and a shifting regulatory and economic environment, have become more selective in their balance sheet deployment.

The graphic above shows a related trend: European corporates are allocating a growing share of their overall trade finance business to their lead providers, thus consolidating their wallet. In 2025, corporates awarded on average an impressive 45% of their trade wallet to their lead providers.

Innovative and high-quality digital platforms

Although the trade finance industry has been slower than other markets to experience digital transformation, digitization is coming—and corporates have increasingly started focusing on the digital offering of their trade finance providers. In 2019, fewer than 1 in 5 large European corporates cited “quality of digital platform” as an important selection criterion for trade finance providers. In 2025, that share is closer to 1 in 3.

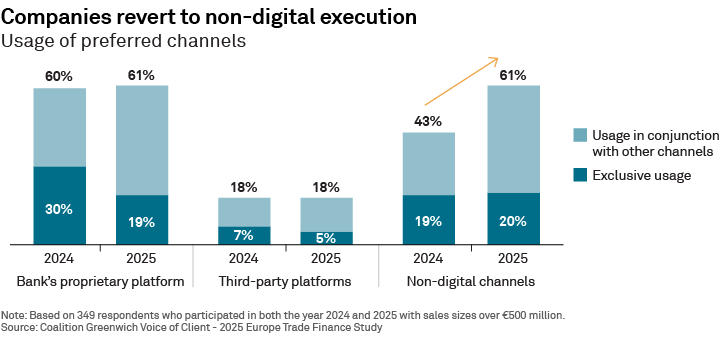

However, the digitization process in European trade finance took a pause last year. Corporate usage of digital platforms was unchanged from 2024–2025. Over the same period, the use of non-digital channels for trade finance transactions spiked to 61% of large European corporates from just 43%.

This surge in non-digital execution is hardly surprising. Given the volatility, dislocations and uncertainty created last year by wars in Ukraine and the Middle East, attacks on shipping in the Red Sea, and rising trade tensions and tariffs, it makes sense that corporates would take to email and telephone to navigate an increasingly complex and challenging trade environment. If trade wars and increasing supply chain diversification continue generating the need for more transactions that are less “commoditized,” usage of non-digital channels can be expected to remain elevated for some time.

Nevertheless, we believe firmly that the current slowdown in digital adoption and the return to non-digital execution represents only a temporary blip, and that the trade finance industry will continue inching its way toward digital execution and transformation—at least for letters of credit and other standardized transaction types. As it does so, we believe trade finance will follow a similar evolutionary path as that seen in other industries: As corporates move more of their routine business to digital channels, they will supplement their use of proprietary bank platforms with increased activity on third-party platforms.

Sustainability plateau

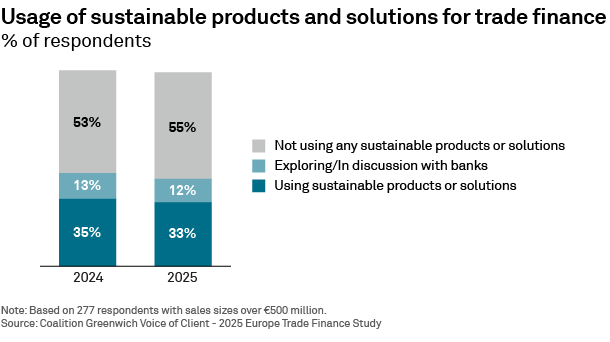

The adoption of sustainable trade finance tools and strategies has apparently reached at least a temporary plateau in the treasury departments of large European companies. About 1 in 3 large European corporates use sustainable products or solutions in trade finance—a share that is down slightly from last year.

Although sustainability has lost momentum in trade finance, we do not believe it is going away. On the contrary, provisions of EU regulations require some large corporates to consider sustainability in supply chain management and other areas. Those rules should prevent usage of sustainable trade finance from falling much further. However, both corporates and banks appear to have shifted from proactive strategies to a reactive stance, with corporates treating sustainability in trade finance more as a compliance issue, and banks focusing on sustainability mainly at the request of clients.

About the authors

Dr. Tobias Miarka leads corporate banking research globally at Crisil Coalition Greenwich. Melanie Casalis and Mimi Miletic specialize in corporate banking, cash management and trade finance services in Europe.

Acknowledgements

The authors gratefully acknowledge the contributions of our core operational research team focusing on banking research from corporates in Europe: Manish Kawatra, Siddarth Mehta and Sibisha Judy.

Between March and September 2025, Crisil Coalition Greenwich conducted 522 interviews with corporates with annual revenues of €500 million or more across Austria, Belgium, France, Germany, Ireland, Italy, Luxembourg, the Netherlands, Nordic countries, Portugal, Spain, and the United Kingdom. Interview topics included product demand, quality of coverage and capabilities specific to trade finance.