Greenwich Associates expects both usage rates and allocations to broaden as institutions embrace ETFs for an expanding number of applications and asset classes, and as ETF providers continue to innovate in ways that make their product offerings more flexible and appealing to institutional investors.

This annual report, in its fifth year, reveals a steady increase in ETFs and several important developments suggest ETFs are now being integrated into institutional investors’ standard toolsets:

- Nearly half of institutional ETF users now allocate more than 10% of total assets to ETFs.

- ETFs are gaining traction in asset classes outside equities, especially in fixed income, where changes in market structure could boost ETF use.

- ETF holding periods are lengthening. The share of institutions reporting average holding periods of two years or longer jumped to 49% in 2014 from 36% in 2013.

- In 2014, approximately 80% of participating institutions using ETFs are employing them as a means of obtaining core portfolio exposures—making it the most common ETF application among study participants. That share is up from 74% using ETFs for this task in 2013.

Methodology

Greenwich Associates interviewed a total of 201 U.S. based institutional exchange-traded fund users in an effort to track and uncover usage trends.

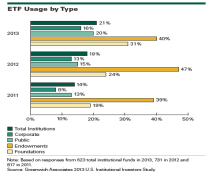

The respondent base of ETF users included 49 institutional funds (corporate pensions, public pensions, foundations and endowments), 32 asset managers (firms managing assets to specific investment strategies/guidelines), 31 insurance companies, 70 RIAs, and 19 investment consultants.