Table of Contents

Equity brokers in the emerging markets are rewarded for consistency. Institutional investors like to trade with firms that remain committed to providing high-quality coverage of regional markets and sectors throughout the inevitable ups and downs. That being the case, brokers had ample opportunity to display their dedication to emerging markets this year. An already volatile industry faced a host of new headwinds, ranging from a collapse of oil prices and currency gyrations to a slowdown in China and economic trouble in Brazil, Argentina and Venezuela.

As in the past, emerging markets equity trading volumes this year have tended to concentrate with bulge-bracket brokers that maintain sophisticated trading platforms across global markets. Institutions often use the global firms as executing brokers for CSA transactions used to compensate providers of research.

“By comparison, the emerging markets equity research market business is more broadly distributed, since the need for local expertise and access to local company management teams provides opportunities for local firms and regional and sector specialists,” says Greenwich Associates consultant John Colon.

Greenwich 2015 Share and Quality Leader designations are awarded to brokers based on the results of interviews conducted by Greenwich Associates with 46 equity investors in CEEMEA and 62 in Latin America at U.S., European and Brazilian institutions. Greenwich Quality Leaders are firms who receive quality ratings from their institutional clients that top those awarded to competitors by a statistically significant margin.

Greenwich Leaders: CEEMEA

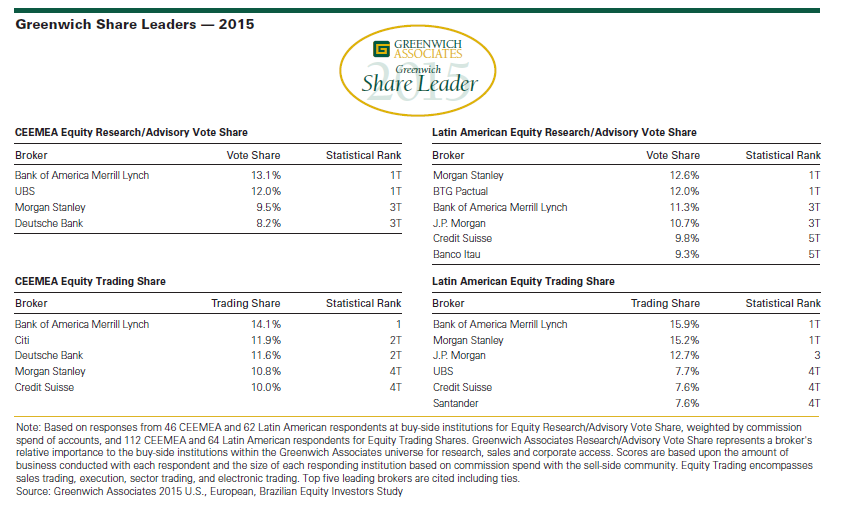

Bank of America Merrill Lynch and UBS are tied atop the market for equity research/advisory services with commission-weighted vote shares between 12.0% and 13.1%, followed by another statistical tie between Morgan Stanley and Deutsche Bank, with vote shares between 8.2% and 9.5%. These firms are the 2015 Greenwich Share Leaders in CEEMEA Equity Research/Advisory.

Morgan Stanley and UBS are the 2015 Greenwich Quality Leaders in CEEMEA Equity Research Product & Analyst Service, while Bank of America Merrill Lynch and UBS are the 2015 Greenwich Quality Leaders in CEEMEA Equity Sales & Corporate Access.

Bank of America Merrill Lynch is the clear leader with a commission share in institutional trading of 14.1%. Citi and Deutsche Bank are statistically tied second with shares between 11.6% and 11.9%, followed by Morgan Stanley and Credit Suisse, which are also statistically tied with shares of 10.0%–10.8%. These firms are the 2015 Greenwich Share Leaders in CEEMEA Equity Trading.

Greenwich Leaders: Latin America

The 2015 Greenwich Share Leaders in Latin American Equity Research Product & Advisory Service are Morgan Stanley and BTG Pactual, tied with commission-weighted vote shares of 12.0%–12.6%, followed by Bank of America Merrill Lynch and J.P. Morgan, which are tied with shares between 10.7% and 11.3%. Credit Suisse and Banco Itau round out the group with statistically tied shares of 9.3%–9.8%.

The 2015 Greenwich Quality Leaders in Latin American Equity Research & Analyst Service are Banco Itau, Bank of America Merrill Lynch, BTG Pactual, J.P. Morgan and Morgan Stanley. The 2015 Greenwich Quality Leaders in Latin American Equity Sales & Corporate Access are Banco Itau, Bank of America Merrill Lynch and BTG Pactual.

Bank of America Merrill Lynch and Morgan Stanley are tied leading the market for Latin American equity trading with commission trading shares of 15.2%–15.9%, followed by J.P. Morgan at 12.7%, and the trio of UBS, Credit Suisse and Santander, which are statistically tied with shares between 7.6% and 7.7%. These firms are the 2015 Greenwich Share Leaders in Latin American Equity Trading.

Consultants Jay Bennett, John Colon and John Feng advise on the institutional equity markets globally.

MethodologyFrom March to May 2015, Greenwich Associates interviewed 108 institutional investors in CEEMEA and Latin American equities at U.S., European and Brazilian institutions about the research and sales services they receive from their brokers. These portfolio managers and traders were also asked about current market practices, trends and compensation.

© 2015 Greenwich Associates, LLC. Javelin Research & Strategy is a division of Greenwich Associates. All rights reserved. No portion of these materials may be copied, reproduced, distributed or transmitted, electronically or otherwise, to external parties or publicly without the permission of Greenwich Associates, LLC. Greenwich Associates®, Competitive Challenges®, Greenwich Quality Index®, and Greenwich Reports® are registered marks of Greenwich Associates, LLC. Greenwich Associates may also have rights in certain other marks used in these materials.

The Greenwich Quality LeaderSM and Greenwich Share LeaderSM designations are determined entirely by the results of the interviews described above and do not represent opinions or endorsements by Greenwich Associates or its staff. Such designations are a product of numerical scores in Greenwich Associates’ proprietary studies that are generated from the study interviews and are based on a statistical significance confidence level of at least 80%. No advertising, promotional or other commercial use can be made of any name, mark or logo of Greenwich Associates without the express prior written consent of Greenwich Associates.