The liquidity profile of the corporate bond market has undergone significant change. Institutional investors broadly agree that the amount of principal-sourced dealer liquidity has declined in the past year.

Among participants in Greenwich Associates 2015 Corporate Bond Liquidity Study, most believe this “new normal” is a risk to their portfolio, and over half anticipate further declines in liquidity provided by dealers.

But new alternatives exist to lubricate the market and ensure that credit flows smoothly. While the market has likely changed for good, a few paths forward are starting to emerge.

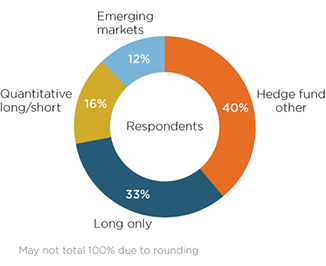

MethodologyBetween December 2015 and February 2016, Greenwich Associates interviewed 58 institutional corporate bond investors located in the U.S. and Europe. Questions focused on corporate bond liquidity, the market’s evolution and new technology solutions.