As the world moves closer to the U.K referendum on continued EU membership on June 23, what once seemed a remote possibility now seems increasingly likely—or at least possible. Some canny observers argue that the race is now so narrow that even the performance of England’s football team in the 2016 European Championship a day or two prior to the polling date could be enough to tip the outcome in one direction or the other.

In hindsight, many business leaders regret Prime Minister David Cameron’s commitment to hold a referendum if he won the 2015 general election, giving in to calls from his own Conservative MPs and the U.K. Independence Party (UKIP). Whatever the next few weeks will bring, it is clear that this decision has prompted uncertainty in an already fragile business environment.

Setting aside the political implications, businesses both in the U.K. and on the Continent might soon be forced to contend with one of the biggest economic shifts in a generation.

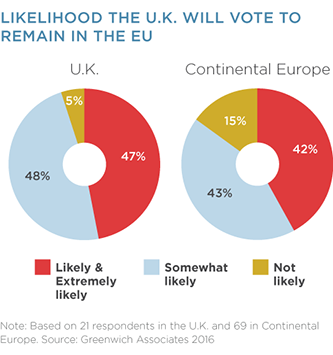

It is unclear how businesses are dealing with the uncertainty in the run-up to the vote, how prepared companies are for an increasingly likely Brexit, and whether the looming referendum is impacting companies’ investment strategies and their relationships with their banks. To explore these critical questions, Greenwich Associates interviewed corporate treasurers at 90 large Western European corporates in the U.K. and on the Continent during April.

MethodologyBetween April 12 -27, 2016 Greenwich Associates conducted 90 interviews with corporate treasury professionals at corporations with sales in excess of €500 million of which 21 were domiciled in the U.K. and 69 on the Continent. Subjects covered included the anticipated likelihood of the U.K. exiting the European Union, how prepared companies are for an exit, and whether the upcoming referendum is impacting investment strategies of companies and their relationships with their banks.