The Markets in Financial Instruments Directives II (MiFID II) is scheduled to go into effect in January 2018. Much of the discussion and debate so far has focused on the new requirements mandating the separation of research payments from trading commissions (unbundling). This will undoubtedly have a profound effect on the market for investment research. Receiving far less focus, however, is the other half of the unbundling equation—how related changes in trading services will impact the market.

With research fully unbundled from trading, asset managers will select their trading counterparties based solely on their trading prowess: execution performance, liquidity sourcing, algorithmic products, and overall service. MiFID II regulations also include new rules specifically addressing trading—including new pre- and post-trade requirements and regulations around dark pool caps and trading venues. Taken together, these new regulations have the potential to transform the trading landscape in Europe and beyond.

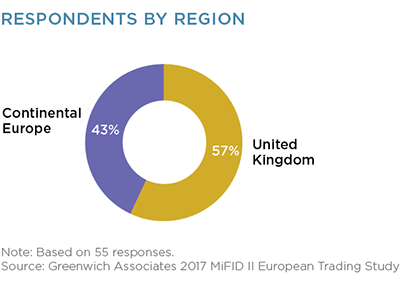

MethodologyFrom March to April 2017, Greenwich Associates interviewed 55 buy-side traders and head traders based in Europe about expected changes to their trading workflow following the implementation of the MiFID II regulations in 2018.