Table of Contents

After several quarters of growth in fixed-income revenues, damped by a lull during the second quarter of 2017, market participants eagerly anticipate the impact that rate rises and tapering will have on volatility.

As a result, there has been a significant pickup in hiring activity for fixed-income professionals, as banks look to add to their sales and trading desks to better service clients. In addition, a number of banks impacted by previous balance sheet constraints and changes in strategy are starting to turn the corner and return to a more stable footing.

“The end result of all this activity will be a much more competitive market environment—especially for the business of the largest buy-side firms that are accounting for an ever-growing share of fixed-income trading volume and dealer trading revenues,” says Greenwich Associates Managing Director Frank Feenstra.

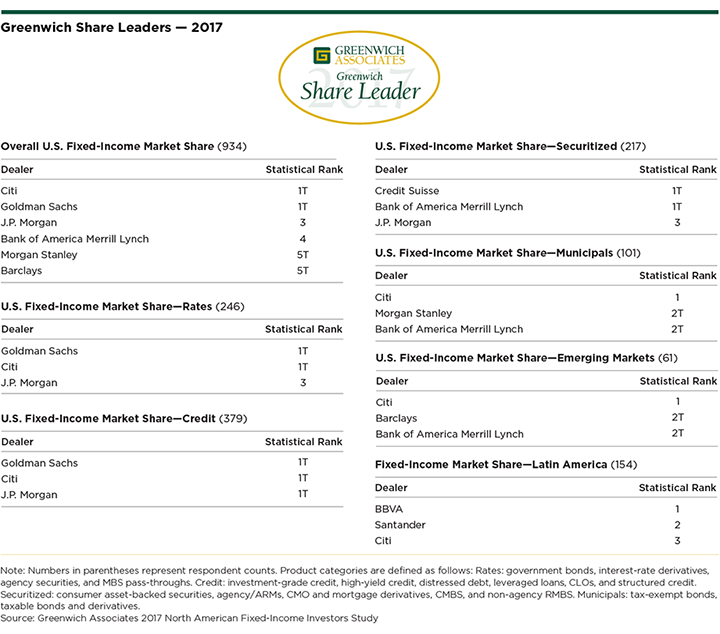

The buy side is diversifying their list of counterparties and adding new ones, as non-bulge-bracket firms are starting to make inroads. However, the increase in competition on the sell side has not yet affected the largest dealers in the U.S. market. The six dealers that make up the 2017 Greenwich Share Leaders℠ in Overall U.S. Fixed Income — Citi, Goldman Sachs, J.P. Morgan, Bank of America Merrill Lynch, Morgan Stanley, and Barclays — still capture the vast majority of fixed-income trading volume and revenue.

Dealers from this group also dominate the underlying product markets in U.S. fixed income. In both Rates and Credit Products, the 2017 Greenwich Share Leaders are Citi, Goldman Sachs and J.P. Morgan. In Emerging Markets, the 2017 Share Leaders are Citi, Barclays and Bank of America Merrill Lynch, and in Municipals, the Share Leaders are Citi, Morgan Stanley and Bank of America Merrill Lynch. Only in Securitized Products does a seventh dealer claim a spot on the list, with Credit Suisse joining Bank of America Merrill Lynch and J.P. Morgan as the 2017 Share Leaders.

(In Overall Fixed Income, Greenwich Associates names the top five firms by market share as Share Leaders (including ties). In individual product categories, Greenwich Associates names three Share Leaders.)

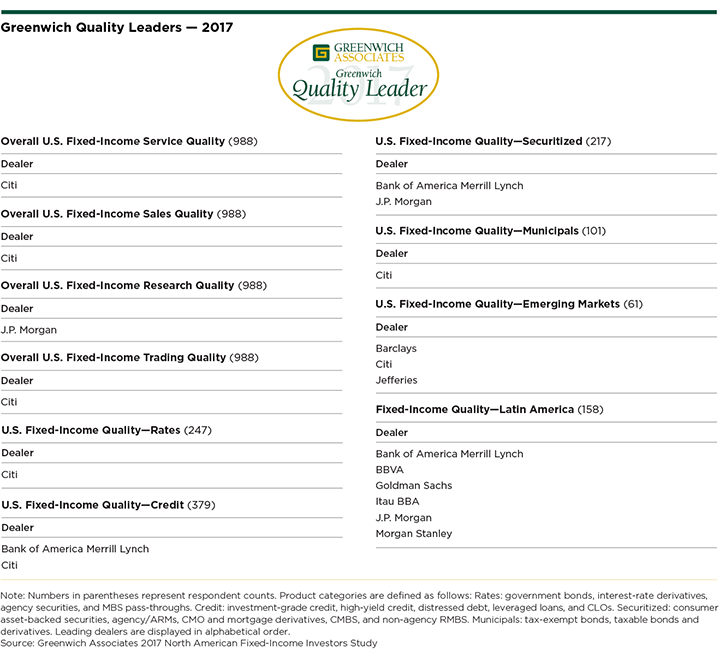

As the buy side continues to look for their top dealers to provide service commensurate with the amount of business they allocate to them, it is not surprising that many of these same dealers claim the title of Greenwich Quality Leader℠. Citi wins the designation as the 2017 Greenwich Quality Leader in Overall U.S. Fixed-Income Service, Overall Sales, Overall Trading, and in Rates and Municipals. Citi is joint Quality Leader with Bank of America Merrill Lynch in Credit, and with Barclays and Jefferies in Emerging Markets. J.P. Morgan is the 2017 Greenwich Quality Leader in Overall U.S. Fixed-Income Research and is joint Quality Leader with Bank of America Merrill Lynch in Securitized Products.

Citi also leads in electronic trading, which accounts for almost 45% of the fixed-income volume traded by U.S. investors. Citi and second-ranked Goldman Sachs make it into the top three for online trading in rates, credit and pass-throughs.

Hiring Surge

In terms of hiring activity, there is one clear sign that the job market is on the rebound: the return of the two-year contract for fixed-income professionals—a feature that has hardly been spotted in the U.S. market in recent years. Demand for talent is being stoked in part by the emergence of smaller U.S. dealers, Canadian and Japanese banks and by the re-emergence of European firms that followed a more focused strategy for their fixed-income business following the crisis.

Coming into 2017, Greenwich Associates research had picked up an increasing number of buy siders who believed that at least two of their incumbent dealers would win less market share with them going forward. However, in 2017 that number decreased by 25%, as clients are seeing less turmoil on the Street, and many of the strategic shifts in the competitive landscape have already taken place. “Many banks see an opportunity to expand their presence in select products and, as a result, are competing more aggressively for client business,” says Greenwich Associates Managing Director James Borger. “We haven’t seen this level of bank-to-bank personnel movement since pre-crisis years.”

Smaller Dealers Find Traction with Investors

Demand for talent is not limited to one particular type of sell-side firm, with bulge-bracket dealers, European firms and U.S. regional and specialist dealers all hiring. Regional and specialist dealers are expanding staffing levels as they gain increased traction with U.S. institutional investors.

“Even as the buy side continues to allocate a large portion of their business to the bulge-bracket dealers, investors are on a constant hunt for liquidity,” says Greenwich Associates consultant David Stryker. “As a result, they are more tha open to trading with smaller dealers that might serve as a liquidity source—especially in relatively illiquid products.”

Over the past year, investors have added one to two additional counterparties, on average, and dealers outside the bulge bracket have typically been the beneficiaries.

Concentration Among Dealers and Investors

At first glance, it would seem that the success of smaller dealers would lead to a less concentrated market—especially since many of their gains are due to opportunities created by shifts in strategy on the part of larger dealers.

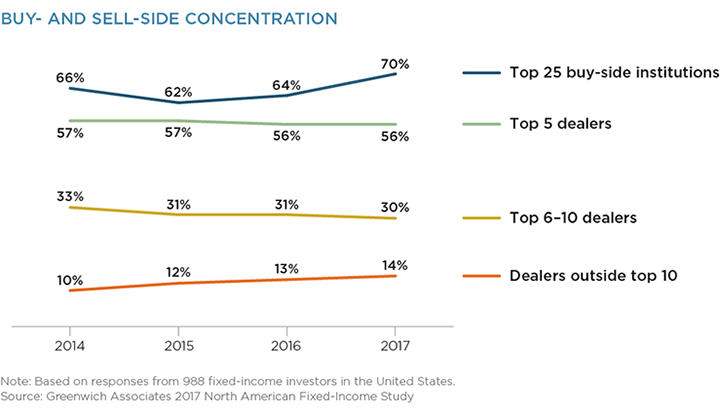

Indeed, since 2014, the share of U.S. institutional fixed-income trading volume executed through the 10 largest fixed-income dealers declined to 86% from 90%. Meanwhile, the share captured by dealers outside the top 10 climbed to 14% from 10%. However, it is critical to note that nearly all that volume came not from the market’s biggest dealers, but rather from the group of dealers ranking 6–10 in share. Among the top five dealers, cumulative market share has held at a relatively stable 56%–57%.

The continued concentration of trading volume with the biggest dealers is being driven by developments on both sides of the Street. On the sell side, heightened capital and balance sheet requirements have driven banks to take a close look at their approach to each asset class in fixed income and their allocation of resources to individual clients. “Buy-side institutions need to toe a fine line between doing enough business to be an important client that their top dealers will provide premium service to and their need to source liquidity in selected products from smaller sell-side firms,” says Greenwich Associates Managing Director Woody Canaday.

On the buy side, concentration is even more pronounced. In terms of notional trading volume, the 25 largest institutions now account for 70% of total notional volume across fixed-income products—a share that has climbed from two-thirds in 2014. “With the change in sell-side strategies, dealers are laser-focused on the largest buy-side firms,” says Frank Feenstra. “This trend is not limited just to the bulge-bracket dealers, however. Increasingly, smaller firms are looking for ways to earn business from these large firms in the asset classes on which they focus.”

ETFs: A Source of Liquidity

Exchange-traded funds (ETFs) have established themselves as an alternative investment vehicle in the previously OTC-only institutional market. One in four U.S. institutional credit investors now invests in bond ETFs. While much of this ETF demand is related to portfolio hedging, a large number of institutional investors are trading credit ETFs as they seek out alternative sources of liquidity. About 40% of the institutions in the Greenwich Associates 2017 U.S. Fixed-Income Investors Study say they use ETFs to gain access to a liquid investment vehicle in their credit portfolios.

Greenwich Share and Quality Leaders

Greenwich Associates asked 1,000 investors at the 500 institutions participating in its 2017 U.S. Fixed-Income Investors Study to name the dealers they use in a range of fixed-income products and to estimate the amount of trading business allocated to each dealer. Investors were also asked to rate the quality of these dealers in a series of product and service categories. Dealers that received quality ratings topping those of competitors by a statistically significant margin were named Greenwich Quality Leaders.

Consultants Frank Feenstra, Woody Canaday, Andy Awad, James Borger, and David Stryker advise on fixed-income markets in the United States.

MethodologyBetween February and May 2017, Greenwich Associates conducted 1,000 interviews across 500 institutions with investors active in fixed income in the United States. Interview topics included trading and research activities and preferences, product and dealer use, service provider evaluations, market trend analysis, and investor compensation.