Table of Contents

U.S. companies are using more banks, more credit and more providers in cash management and other functions to support business in international markets. Those themes—some of which undoubtedly point to a strengthening of the U.S. and global economy—are unfolding amid a continued shift in strategy on the part of both the largest U.S. and global banks, and among smaller domestic and foreign players eager to expand or establish their U.S. franchises.

Together, these changes have pushed turnover levels in corporate banking relationships to historic highs. Companies are seeking out new providers, big banks are narrowing their focus, and foreign banks are aggressively competing for business with competitively priced credit and specialized coverage of markets key to U.S. companies’ international aspirations. More than half the U.S. companies participating in Greenwich Associates research expect to move corporate banking business among providers in the next year—a 7% increase from 2016, a year that already featured large amounts of “money in motion.”

Greenwich Share and Quality Leaders: Corporate Banking

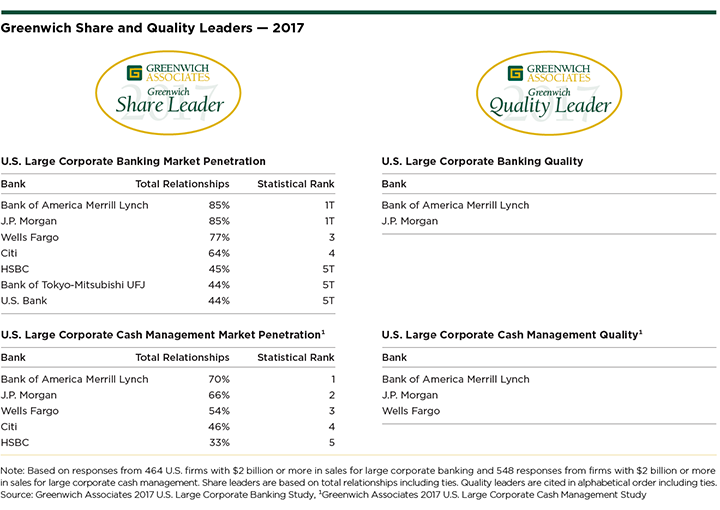

Amid these conditions, J.P. Morgan and Bank of America Merrill Lynch play the role of leaders of the U.S. large corporate banking market. Eighty-five percent of large U.S. companies use Bank of America Merrill Lynch and/or J.P. Morgan for corporate banking services. In third place is Wells Fargo at 77%, followed by Citi at 64% and a three-way tie for fifth: HSBC (45%), Bank of Tokyo-Mitsubishi UFJ and U.S. Bank (44%). These firms are the 2017 Greenwich Share Leaders℠ in U.S. Large Corporate Banking. Bank of America Merrill Lynch and J.P. Morgan both also claim the title of Greenwich Quality Leaders℠ in this critical category.

The 2017 Greenwich Share leaders have one thing in common: All saw their market penetration scores fall over the past year. This reduction reflects the shift in strategy that has been playing out since the global credit crisis brought on new capital reserve requirements and balance sheet pressures for the world’s largest banks.

As a group over the last several years, the biggest U.S. and global corporate banks have narrowed their focus and are now directing capital and distinctive coverage primarily to companies with the best profit potential. In many cases, implementing that new approach has meant reducing coverage, moving clients to less expensive coverage teams, or even ceding the relationships of smaller companies and customers falling short of internal profitability targets. “Big U.S. banks and global banks are looking to grow their corporate banking revenues by earning more of the global and domestic wallets of their best customers, rather than competing aggressively for new customers,” says Greenwich Associates Managing Director Don Raftery.

This change is creating new opportunities for regional U.S. banks and several foreign competitors making a strong push into the U.S. market. Leading this charge are Japanese banks like Bank of Tokyo-Mitsubishi UFJ and Mizuho. Given the meager returns on capital in the near zero-interest-rate environment of their home county, these banks have plenty of incentive to lend to companies in the U.S.—a business not viewed as particularly attractive to U.S. banks as a stand-alone product. However, as Japanese banks step up their lending, they also are more frequently winning higher-margin business in FX, interest-rate derivatives and trade finance. In fact, for the first time, a Japanese bank, Bank of Tokyo-Mitsubishi UFJ, won designation as a Greenwich Share Leader in U.S. Large Corporate Banking and Greenwich Quality Leader in U.S. Large Corporate Trade Finance this year.

Wanted: Banks for Growing International Business

Japanese banks are also winning mandates from U.S. companies for international cash management, with an obvious focus on the Japanese market. In that respect, Japanese banks are hardly alone. In fact, over the past 12 months, companies’ growing demand for cross-border banking services that support international business and trade has been one of the most important trends in U.S. corporate banking.

The share of U.S. companies using a bank for inbound or outbound services increased for every region covered by Greenwich Associates, including Western Europe, Asia Pacific, Latin America, Central and Eastern Europe, and the Middle East and Africa. “Although those increases bode well for global trade and the global economy as a whole, the most immediate beneficiary of this trend is probably Citi, which ranks No. 1 among U.S. companies for international banking service in all those regions,” says Greenwich Associates Managing Director John Colon.

A Surge in Demand for Bank Credit—Finally

One of the big mysteries about the relatively slow pace of the U.S. economic recovery since the global financial crisis has been persistently low corporate borrowing rates. Soft demand for credit has sparked a controversial debate. Were weak economic prospects and a lack of confidence holding back corporate demand, or have capital reserve requirements and other new bank rules reduced supply and constrained economic growth?

Greenwich Associates research throughout the period following the global crisis suggested that for an extended period of time, available bank credit for large, strongly rated companies far outstripped demand. But whatever the ultimate answer to that question, a surge in corporate use of bank credit last year is good news. Overall, the share of large U.S. companies using bank credit jumped to 95% in 2017 from 88% in 2016.

That pickup drove an increase in the average number of banks used by large U.S. companies for credit, which climbed to 7.5 in 2017 from 7.1 in 2016. As noted earlier, some of that increase is likely attributable to the impact of foreign competitors—especially Japanese banks—that are committing significant balance sheet to the U.S. corporate lending business and emerging as a viable alternative credit source for many companies.

Top Nonbank Firms and Fintech Players

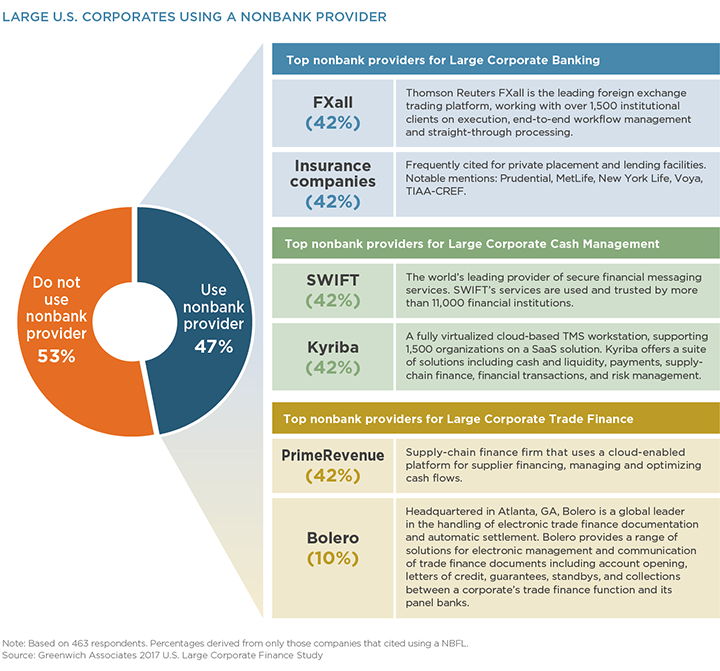

One of the biggest trends across global financial services is the rise of fintech and other “nonbank providers.” In U.S. corporate banking, the list of nonbanks competing for a share of companies’ wallet ranges from old-school life insurance companies edging into the lending game to cloud-based service providers for managing cash, FX, risk, and other treasury functions. The growth of these firms is undoubtedly helping to push up the number of banking providers used by U.S. companies overall.

Forty-seven percent of the large companies participating in our 2017 U.S. Large Corporate Banking Study use a nonbank provider. The following graphic shows the most-commonly used firms.

Greenwich Share and Quality Leaders: Cash Management

Many of the themes driving the U.S. large corporate cash management business today mirror those affecting corporate banking as a whole: Turnover in business and bank relationships remains near historic highs, U.S. companies are making a strong move to secure banking services needed to support growing international businesses, and opportunities created by these trends are opening the door for regional players, Japanese banks and other foreign competitors. Together these trends are increasing the average number of providers companies employ—a number that is also receiving a boost from the fact that 39% of large companies are now using nonbank providers in some area of cash or treasury management.

Forty-seven percent of the companies participating in this year’s study expect to move cash management business among providers in the next 12 months. Although that share is down slightly from 2016, the fact that nearly half of large U.S. companies are planning to make this change is impressive, given the high switching costs and operational disruptions associated with changing cash management providers. “These turnover numbers are critical to banks, because when a company decides to shift providers it’s not usually a change at the margins. They typically move a meaningful share of their wallet,” says Don Raftery.

One factor contributing to this high turnover is companies’ growing demand for cross-border cash management services. The share of U.S. companies using a provider for international cash management increased for every region covered in the study, with the largest gains coming from Latin America and the Middle East and Africa.

Although this increased demand for cross-border service has been a boon to Japanese banks and other foreign banks offering specialized coverage in their home markets, the primary beneficiaries have been big U.S. banks with robust global networks. Citi, the top cash management provider to U.S. companies in every major geographic region outside the U.S., is likely to capture a sizable amount of this new cross-border business, along with HSBC.

Meanwhile, companies cite Bank of America Merrill Lynch and J.P. Morgan as most likely to capture the biggest shares of their cash management “money in motion” overall. This will help fortify their positions at the top of this market. About 70% of large U.S. companies use Bank of America Merrill Lynch as a cash management provider—a market penetration score that edges out second place J.P. Morgan at 66%. Wells Fargo is third at 54%, followed by Citi at 46% and HSBC at 33%. These banks are the 2017 Greenwich Share Leaders in U.S. Large Corporate Cash Management. The 2017 Greenwich Quality Leaders in this category are Bank of America Merrill Lynch, J.P. Morgan and Wells Fargo.

Consultants John Colon and Don Raftery specialize in corporate banking, cash management and trade finance services in North America.

From April through September 2017, Greenwich Associates conducted interviews at U.S.-based companies with $2 billion or more in annual revenue with 464 chief financial officers, treasurers and assistant treasurers and 548 cash management specialists and other financial professionals in cash management. Participants were asked about market trends and their relationships with their banks.