Table of Contents

Goldman Sachs leads the flow equity derivatives market in North America, and J.P. Morgan holds the No. 1 spot in Europe. Unfortunately for these firms and the rest of the 2017 Greenwich Share and Quality Leaders℠ in Flow Equity Derivatives, business in this market is...meh.

The U.S. stock market is smashing records on a near daily basis, and equity markets around the world are strong. Globally, however, volatility remains at historically low levels. The lack of volatility reflects and has contributed to a sustained downturn in trading volumes. Although strong equity markets and low interest rates are prompting investors to take money off the sidelines, more and more investment assets are flowing into index funds that don’t require the trading and hedging activity inherent in most active management strategies.

Together, these trends have lessened demand for equity options, swaps and futures, taking the steam out of the flow equity derivatives market. “Brokers in this market would love some volatility—whether it came from a spike in investor conviction or fear,” says Greenwich Associates Managing Director Jay Bennett.

Sluggish demand has not diminished the commitment of the world’s leading brokers to this business. Although banks have become more careful in their allocation of resources and capital—not just in derivatives but across the board—the 2017 Greenwich Leaders are defending their positions to be ready for an uptick in volume in this critical, and in spots highly profitable, business.

The leading flow equity derivatives brokers maintain broad footprints, allowing them to see most of the business that comes into the market, while they also compete to capture as much business as possible from individual clients. “Once you get past the top firms, brokers generally go one way or another—they target broad market penetration or a deep share of wallet among select clients or products,” says Greenwich Associates Managing Director John Feng. “The Greenwich Leaders do both.”

Greenwich Share Leaders

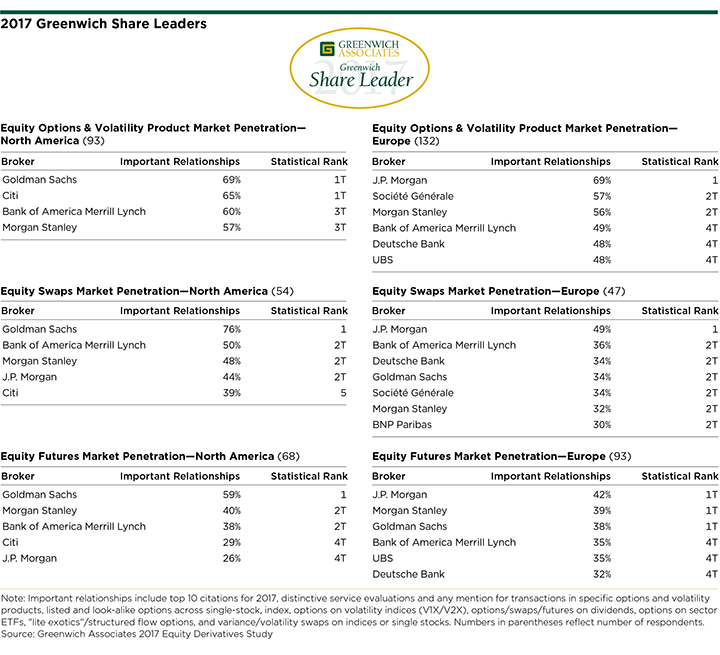

In North America, Goldman Sachs and Citi lead the market in Equity Options & Volatility Products, with relationship penetration levels of 65%–69%, followed by Bank of America Merrill Lynch and Morgan Stanley, which are also statistically deadlocked at 57%–60%. In Equity Swaps, over three-quarters of market participants trade with the leader, Goldman Sachs. Bank of America Merrill Lynch, Morgan Stanley and J.P. Morgan are tied in second place, followed by Citi. With a relationship penetration of 59%, Goldman Sachs also leads in Equity Futures, followed by Morgan Stanley and Bank of America Merrill Lynch in second place, and Citi and J.P. Morgan statistically tied for fourth.

In Europe, J.P. Morgan’s 69% relationship penetration gives the firm a commanding lead in Equity Options & Volatility Products, ahead of Société Générale and Morgan Stanley, which are tied in second place, and the trio of Bank of America Merrill Lynch, Deutsche Bank and UBS, sharing the No. 4 spot. In Equity Swaps, J.P. Morgan also leads with a 49% relationship penetration, followed by six brokers statistically tied with penetration levels between 30% and 36%. In Equity Futures, J.P. Morgan, Morgan Stanley and Goldman Sachs are statistically tied atop the market at 38%–42%, followed by a three-way tie among Bank of America Merrill Lynch, UBS and Deutsche Bank.

Greenwich Quality Leaders

Greenwich Associates research shows a large historic correlation between relationship penetration and quality of service in flow equity derivatives. The reason: When market participants are choosing a broker for a trade, the main drivers of that selection process are: 1) Pricing and execution, which includes broker capital commitment and accounts for nearly two-thirds of the decision; and 2) Sales coverage, which accounts for about 15%.

Since sales, pricing and execution are also primary components of service quality in this market, brokers who rate high on quality also tend to win the most trades. The 2017 Greenwich Quality Leaders in Equity Options & Volatility Products are Citi and Goldman Sachs in North America, and Bank of America Merrill Lynch, Deutsche Bank, J.P. Morgan, and Société Générale in Europe.

Consultants Jay Bennett, John Feng, Thomas Jacques, and Satnam Sohal advise on the institutional equity markets globally, including the use of flow equity derivatives and convertibles.

MethodologyBetween May and June 2017, Greenwich Associates conducted interviews with 102 flow equity derivatives users, including asset managers, hedge funds, insurers, pensions, and banks in North America, and 149 in Europe. Respondents were asked to name the top 5–10 brokers they use for specific products and to rate the firms according to a series of qualitative factors in each product.