In the face of the growth in FX futures trading, Greenwich Associates set out to examine and assess the potential economic benefits of utilizing futures as an alternative to trading in the OTC markets.

To do so, we employed a proprietary quantitative model to analyze the costs associated with trading FX over-the-counter (OTC) against comparable FX futures. The model calculates the cost of opening, maintaining and closing out a position. To validate key inputs into the model and gather feedback on current demand and pricing, we spoke with FX traders on the buy and sell side.

The results show that FX investors can find significant cost savings (upward of 75% in some cases) by trading futures rather than executing a trade in the OTC markets. For those entities subject to Basel III costs, switching to futures from OTC trades could garner even greater savings.

Pure costs savings are not the only reason to consider FX futures. As sell-side dealers become more selective in the clients that they prioritize, some buy-side traders may find liquidity more difficult to access. Others may find that they are getting de-prioritized and receiving fewer services from particular counterparties. As a result, adding the option to trade in a futures environment could help mitigate the effects of shifting sell-side behavior.

Even with these potential cost savings, a switch to futures might not make sense for some FX market participants that trade only infrequently and at relatively small volumes. And for some investors, there may be lingering skepticism about the available liquidity in an exchange-traded environment, even though recent statistics show that average daily volume (ADV) in FX futures equals or exceeds the volume on a major spot exchange.

The results of our analysis prove that even before considering the potentially punitive effects that regulations have on trading costs, trading FX futures can have clear economic benefits. For that reason, we expect FX futures to continue to gain traction as an alternative to OTC trading.

MethodologyThe basis for this report is a proprietary quantitative model designed to analyze the costs associated with trading FX over-the-counter with comparable FX futures. The model calculates the cost of opening a position, maintaining that position and then closing out that position. The costs are broadly defined in the following buckets:

- Spread cost: Defined as the bid-ask spread for the given instrument

- Margin and funding costs: Includes the amount of margin that must be posted by product and the cost of funding that margin

- Intermediation fees: Execution fees, clearing fees and capital usage fees charged by the futures commission merchant or prime broker

- Platform/CCP fees: Exchange, execution and clearing fees charged by the relevant clearinghouse or trading platform

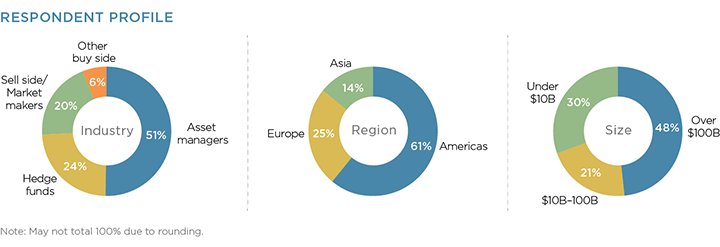

In an effort to validate key inputs into the model and gather feedback on current demand for and consideration of trading FX futures, Greenwich Associates conducted a total of 51 telephone interviews between January and April 2017 with FX traders on the buy and sell side. Study participants provided average bid-ask spreads for FX trades of various sizes, the average platform costs paid for OTC FX execution, the proportion of their futures trades executed at the midpoint, and several other quantitative and qualitative data points.

These results were used to create several scenarios aimed at identifying where futures provide a valid (and in some cases obvious) alternative to trading FX over-the-counter and where current trading habits are best left intact.