Executive Summary

For the better part of a decade, electronic trading has been ubiquitous in the institutional foreign-exchange market. As early as 2007, over half of buy-side institutions trading FX were executing trades either via third-party platforms or banks’ proprietary systems. As institutions get more sophisticated, however, they are demanding more advanced ways of executing their FX transactions.

In recent years, FX investors have been turning to algorithms to access multiple liquidity pools, reduce their trading costs and improve execution quality. Once a tool primarily used to execute equities trades, algos are becoming increasingly popular with FX traders from institutions and corporates alike. However, many buy-side traders are still hesitant to opt for an execution method that requires them to pay a “fee.” What we have found in our research, though, is that as traders more actively use algos, their overall execution costs have dropped meaningfully.

Given the myriad benefits that algos offer, FX traders currently not using algos (and not considering them) may soon have to determine whether they’re putting themselves at a disadvantage by not leveraging all the available tools to achieve the best outcomes for their institution and clients.

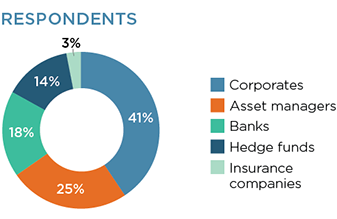

MethodologyBetween August and September 2017, Greenwich Associates interviewed 79 FX traders at hedge funds, asset managers, corporates, and other types of financial institutions in the United States and Europe to gather their perspectives on the perceived benefits of using algos to execute FX trades, insights into their decision-making process on selecting an algo provider, if they do not use algos, why, and how they use TCA as part of their investment process for FX.