Just one week ago we published new research (The Electronic Trading Landscape in 2018) discussing how the low volume, low volatility trading environment was impacting business models and trading preferences in the US equity market.

Then just a few days later, volatility emerged from hibernation with the market plunging and rising like a rollercoaster, with price swings as large as 7%. Therein lies the beauty of financial markets; you can never be complacent as things can and often do turn on a dime.

Having averaged about 6.5bn shares per day in 2017, US equity market volume had begun creeping up in January (on the back of continued strong market performance) averaging about 7.2bn shares per day. For the last week share volume has hovered around 10.9bn shares per day - an over 50% increase. Volatility followed suit, also shooting up dramtically. While I believe that what we are currently experiencing is a temporary deviation from the low volatility / low volume environment we've become accustomed to, it will clearly have a big impact on how people trade.

We noted in last week’s report that liquidity sourcing algorithms are by far the most popular choice of buy side traders. These algorithms trade passively by participating in a number of different dark pools. Liquidity seeking algos were most certainly not the most popular choice last week. In a high volatility environment, passive trading is a bad choice as your orders will be picked off as the market swings up and down.

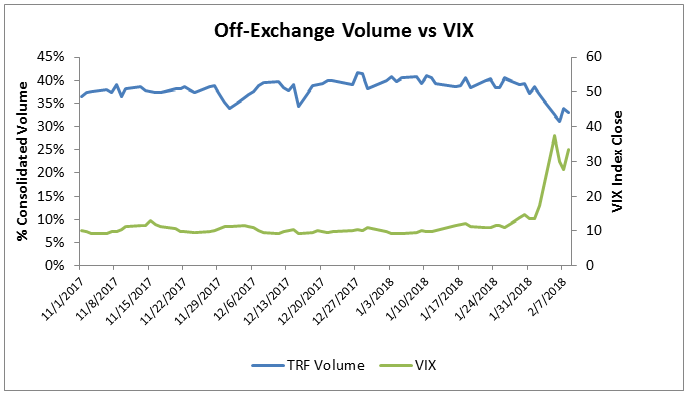

In fact, this shift away from passive dark pool trading can already be seen in the public data.

Trades executed in dark pools and other non-exchange venues are printed to something called the Trade Reporting Facility (TRF). By looking at the public data on reported TRF volume, we can better understand to what extent buy side traders are using dark pools. Having hovered around 40% for most of 2018, the percentage of off-exchange trading dropped sharply to about 21% just as volatility spiked.

The data confirms that traders have in fact pulled back from utilizing dark pools in the last week. Of course, that doesn’t mean dark pools are losing business; with the sharp increase in volume it just means they are getting a smaller slice of a bigger pie. On the flip side, exchanges taking a greater share of consolidated volume indicates an increase in lit volume. This suggests increased usage of aggressive order types such as implementation shortfall and smart order routing strategies, which trade against immediately executable, displayed orders.

While the last week has likely been a hair-raising experience for many investors, it has also provided a nice boost in business for many trading firms. It seems unlikely that that the activity of the last week represents a transition to a new volatility regime, but I could be wrong. The market is always full of surprises.