Executive Summary

Technology innovation in financial markets is severely limited by security and compliance concerns of the market participants. In this age of intraday upgrades, deploying a new application to a potential end user would appear to be the easy part, with the focus placed on feature development and incenting active engagement of these “try-before-you-buy” users. But as anyone in institutional fintech will tell you, moving from “We’ll try it” on the trading desk to “We’ll buy it” is a nightmare.

Financial markets should take note: The consumer market has solved most of these problems, which means institutional markets must quickly follow suit. While infrastructure changes for large financial institutions are complex, the technology to ease these concerns is so accessible and the results so impactful that the benefits of pushing these changes forward are undeniable. Realizing how both vendors and software consumers manage the process today, and how access to the latest and greatest technological innovations can be streamlined is key to understanding the future of financial services computing.

Methodology

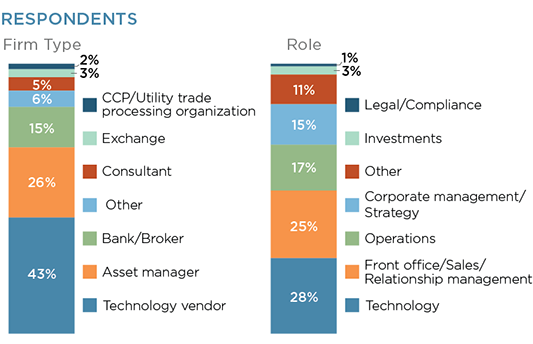

Between September and November 2017, Greenwich Associates interviewed 65 executives from banks, brokerage firms, investment managers, and financial technology providers globally to better understand their experiences and current processes for deploying financial software. Just over 40% of respondents identified themselves as a market participant that uses vendor-provided applications to support trading, 50% as a vendor or technology provider that deploys trading-related software, with the balance identifying in both categories.