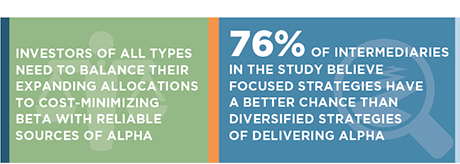

Investors are increasing allocations to focused strategies, or investment strategies consisting of approximately 50 or fewer securities.

Driving this growth is the pressing need for alpha among investors who are: 1) relying on market outperformance to meet their long-term goals and funding needs, and 2) allocating growing shares of their investment portfolios to passive strategies designed to deliver low-cost beta.

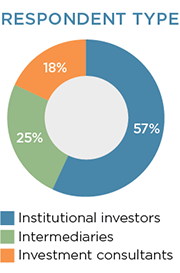

MethodologyBetween September and November 2017, Greenwich Associates conducted a study examining the use of focused equity strategies in the U.S. institutional market. Interviews were conducted with 91 key decision-makers including institutional investors, intermediary platforms and

investment consultants. Questions explored the rationale for seeking out focused strategies, the ways in which they are being incorporated into portfolios and the outlook for these strategies in the future.

Institutional investors include public and corporate pensions as well as endowments and foundations.

Intermediaries include analysts, model teams and key decision-makers in the home offices of wirehouses, broker-dealers, registered investment advisors, and retirement platforms.

Investment consultants provide investment advice, including but not limited to asset allocation, manager research and selection, risk management, and performance analysis, to institutional investors.