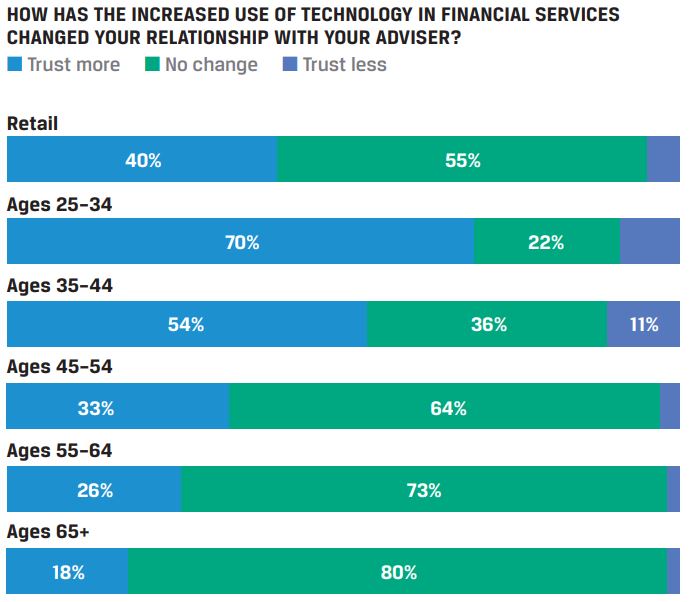

Trust means different things to different people. For instance, our nearly 4,000 recently conducted interviews for the CFA Institute’s “State of Investor Trust” research taught us that saying “I don’t know” improves trust between institutional investors, but hurts trust between a retail investor and their adviser. We also learned that while technology, by and large, improves investor confidence – whether that be a robo-adviser or institutional trading platform – personal relationships continue to act as the foundation for financial decision making.

This echoes what our research has been finding for years. That technology creates business opportunities, makes processes more efficient and yes, does sometimes mean you need fewer people to do the same job. However, in nearly every case technology does not replace people but instead enhanced their ability to work. And not just to trade more effectively or create an asset allocation more quickly, but to maintain and grow more meaningful relationships with clients.

Understanding trust around the world and how it impacts financial markets is of course much deeper and more nuanced than that. But it is that nuance that is increasingly critical to managing client relationships, with whom and wherever in the world they might be.

Click here to go to the full study from the CFA Institute.