Institutional investors aren’t in the investing business—they’re in the risk business. Generating investment returns is increasingly less about picking the right security and more about managing the risk/reward profile of the portfolio over time. Risk management is not, of course, an exact science, as its ultimate goal is to predict the future. And just as every artist has their preferred medium, every portfolio manager and risk analyst also has their own distinct ways of modeling risk.

Risk management platforms of the past, whether built internally by the investment firm or bought off the shelf, were robust but often designed with a singular focus in mind. This has made it hard for investment managers to expand into new markets and new products, as current systems are often insufficient to fully evaluate if the risk is worth the potential reward.

That era is ending, however, as commercially available risk technology now provides an amazing level of flexibility that ensures one firm’s implementation looks nothing like the firm’s across the street. Institutional investors are coming to grips with the size of the opportunity these innovations can offer, and they are spending to ensure they can capture it.

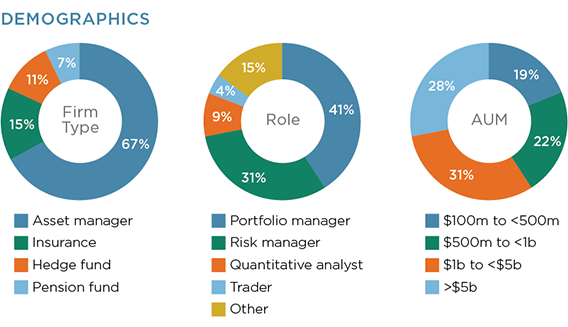

MethodologyIn the first quarter of 2018, Greenwich Associates interviewed 54 asset managers, hedge funds, pension funds, and insurance companies about their use of risk management technology. The analysis, which includes responses from portfolio managers, risk managers, traders, and quantitative analysts, examines current platforms used, concerns with those platforms, demands for new functionality, and drivers for change in the coming year.