Capital Markets Firms Ramp Up Spending on Market Data

August 22, 2023

Asset managers, wealth management firms, banks, and broker-dealers globally are opening their wallets for market data.

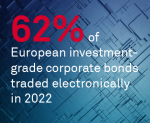

Spending on market data is expected to increase by 10% or more next year in priority areas including equites, fixed income and alternative data, and by at least 5% across other asset classes.